Before Governor Sununu vetoed the tax-hike, big spending, abortion funding, littered with left-wing priorities budget, he vetoed something else. A new broad-based tax disguised and sold as a necessary social good only the State could provide.

income tax

Say Hello to the Claremont Income Tax … and Thank You to our Wonderful Attorney General

So last week, a single Superior Court Judge decided he was the State’s Education-Czar and implicitly ordered -while, of course, claiming he was doing no such thing- the State to -at a minimum- triple spending on public education … which would require a massive expansion in spending by State government (at least an additional $1.6 … Read more

NH Senate Quickly Kills the Democrat Income Tax – So, Was this Just Political Theater?

Jeanne Dietsch proposed an amendment to an unrelated bill that would create an income tax in New Hampshire. It was big news. People reacted. We reported it here. But before the digital ink was even dry, the Democrat majority, NH Senate killed it.

House Republican Leader: Hello, Income Tax. Goodbye, New Hampshire Advantage

Press Release | CONCORD – House Republican Leader Dick Hinch (R-Merrimack) reacted to a proposed non-germane amendment sponsored by Democrats in the Senate and House that would establish a 6.2% payroll tax on some earners in New Hampshire. Amendment 2019-2031s, which is being heard today at 1:00pm, proposes to impose a 6.2% state payroll tax … Read more

Dirty Dan Feltes Says Sununu Lied About Paid Family Leave – But Dirty Dan is the Liar

Chris Sununu supports some sort of legisaltive action on the issue-du-jour of Paid Family Leave. On this, we disagree. And we couldn’t disagree if he wasn’t trying, which he is. Which means Democrat Sen. Dan Feltes claims Sununu lied – is a lie.

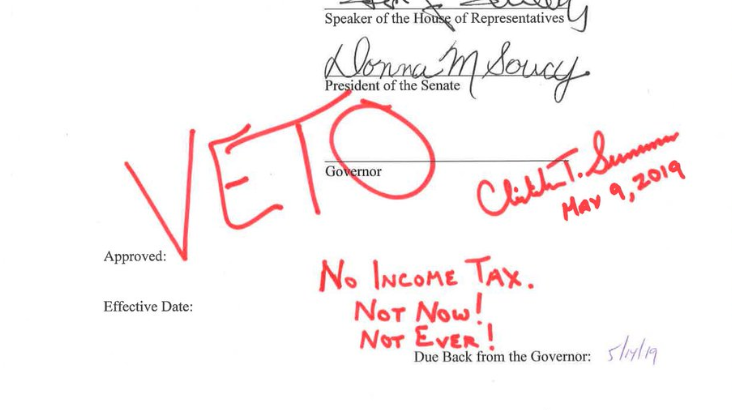

Governor Sununu VETOES the Democrats’ Income Tax!

Today, Governor Sununu kept his promise and vetoed Senate Bill 1 – the Democrats’ Paid Family Leave bill that is nothing but another huge government-run program paid for with a tax on the incomes of hard-working Granite Staters who DON’T WANT an income tax. The Democrats’ solution to paid leave — Senate Bill 1 (SB1) … Read more

Dan Feltes’ Income tax

NH State Senator Dan Felts refuses to admit that his mandatory Paid Family Medical Leave act which will apply a 0.5% tax on a worker’s income, is just that – an income tax. And sooo…. The advertisement highlights Senate Majority Leader Dan Feltes’ fervent support for the creation a mandatory income tax, hidden under the … Read more

Family Medical Leave Insurance Boondoggle

More state mandated insurance The NH’s Democrat legislature is going to pass a bill establishing a system of paid family and medical leave insurance. Having heard more than a few people ask why we need more state mandated insurance it seemed appropriate that as an informed electorate we should understand that need. It must be … Read more

Emails Reveal ‘Taxation Is Theft’ Phrase is Driving NH Democrats Bonkers

Since Democrats took over a majority in both the New Hampshire House and Senate, they have been on a drunken late-night ‘Amazon Prime’ spending spree with YOUR tax dollars. And of course, they have to RAISE TAXES even more to pay for all of their ridiculous spending, to the tune of $417 MILLION new taxes … Read more

Facepalm of the Day – ‘Property Tax is an Income Tax’

Democrats are trying to push their government-run, mandated ‘Paid Family Leave’ program (Senate Bill 1) which is, as most correctly understand, a tax on Granite Stater’s income. Democrats refuse to call this tax on your income an income tax because they know how much a majority of Granite Staters are against an income tax, including … Read more

New Hampshire’s Democrat-Lead Legislature Passes an Income Tax

by Elliot Axelman On Tuesday, March 19th, the Democrat-controlled House passed SB1, the state income tax bill that passed the State Senate last month. Democrats introduced the same bill last year, but could not pass it in the Senate due to the Republicans controlling the chamber. Fortunately for us, Republicans do not love taxes as … Read more

CACR 10: A State Income Tax

What exactly is a CACR? Before the House Ways and Means committee this session is Constitutional Amendment Concurrent Resolution 10 (CACR 10). Ways and Means is the committee responsible for taxation. CACR 10 is a measure relating to a state income tax. The sponsor is Democrat Representative Schamberg of Wilmot. He intends that revenue from … Read more

If elected, Dems PROMISE to pass an Income Tax for Family Medical Leave in NH

Democrat Gubernatorial Candidate Molly Kelly and her fellow Democrats running for office are touting Family Medical Leave as one of the most important issues in the upcoming election. What they don’t tell Granite Staters is that the legislation already exists and it is a TAX on income for employees and employers. Democrats won’t tell the … Read more

Data Point – who pays MORE than their “fair” share?

That would be the 50% of Americans who pay the 97% of the income tax taken by the Federal Government:

Bloomberg looked into the 2016 individual returns data in detail for some additional insights illustrated in the charts below:

- The top 1 percent paid a greater share of individual income taxes (37.3 percent) than the bottom 90 percent combined (30.5 percent).

- The top 50 percent of all taxpayers paid 97 percent of total individual income taxes.

That’s just the Feds. Now crank in all of the income taxes taken in by

Data Point – Individual Income Taxes set record

The federal government collected a record $1,521,589,000,000 in individual income taxes through the first eleven months of fiscal 2018 (October 2017 through August 2018), according to the Monthly Treasury Statement released today. Yet, the Progressive / Socialist / Democrats keep saying we have a revenue problem. Seriously? However, the federal government also ran a deficit … Read more

Keith Erf – candidate for NH State House, Hillsborough County 2 (Weare/Deering)

I’m Keith Erf, candidate for state representative in Weare and Deering. I’m running for State representative to champion limited government. I’ve lived in Weare for 37 years. My wife, Louisa, and I raised four children here where they attended Weare schools.

I started my business, KyTek, in 1991 developing automated systems for the publishing industry. As a small business owner and member of the Weare Finance Committee, I’ve seen firsthand how NH business taxes, property taxes and expanding government negatively impacts our communities. We need representation in Concord that fights for our best interests, limiting government and taxation so current and future generations can afford to live and work in our community.

As a member of the Weare Finance Committee, I look to find a taxpayer-friendly balance between the needs of the town and schools and the costs to our residents. From the vantage point of the Finance Committee I have learned that we need representation in Concord that will avoid legislation that places costs on Weare and Deering requiring us to increase our local property taxes.

There’s a reason why NH ranks much higher than Maine

“…The compilation data is stunning.

In many of the selected reports, Maine lagged far behind New Hampshire for competitiveness for new industry, tax burden, cost of doing business, workforce education, infrastructure, regulatory environment and labor supply. New Hampshire came in, nationally, as the 15th best state in terms of business climate and taxation — the best in New England, by a long shot. Maine’s average score designated our state the 34th best for business climate, trailing every other New England state except Connecticut.

But the rub becomes apparent when one studies the data.

HB628 Was Never About Creating a Family Medical Leave Insurance Program.

Since late 2017, leading up to today, we’ve written or shared at least twenty-three articles opposing HB628, the so-called Family Medical Leave Act. This makes (at least) twenty-four. Why so many? Until very recently neither the governor nor Republican Majority leadership had made a noise that wasn’t fawning.

Since late 2017, leading up to today, we’ve written or shared at least twenty-three articles opposing HB628, the so-called Family Medical Leave Act. This makes (at least) twenty-four. Why so many? Until very recently neither the governor nor Republican Majority leadership had made a noise that wasn’t fawning.

And while a recent joint committee vote to ITL the bill has people singing praises, until the floor vote adds a final stake (at least for this session) I’m not convinced it’s dead with good reason.

If the Tax On Income Isn’t Troubling Enough…

The proposed Family Medical leave legislation will create an income tax but there’s plenty more wrong with this bill if the tax isn’t enough. Elliott Axelman joins me to discuss the many troubling facets of this awful piece of legislation (HB 628). Original Blog Page Post can be Found Here

NH Looks to Impose an Income Tax

Kimberly Morin joins me to discuss the latest effort by progressives to institute a broad-based taxing structure in state government.