Democrats are trying to push their government-run, mandated ‘Paid Family Leave’ program (Senate Bill 1) which is, as most correctly understand, a tax on Granite Stater’s income.

Democrats refuse to call this tax on your income an income tax because they know how much a majority of Granite Staters are against an income tax, including Democrat voters and especially Independents.

They can put lipstick on this behemoth government pig program all they want but an income tax is an income tax is an income tax. From the *gasp* dictionary:

-

tax levied by a government directly on income, especially an annual tax on personal income.

From a previous article by the Monitor:

It would require businesses to provide insurance or send 0.5 percent of employees’ weekly wages to the state.

Pretty easy to understand for most people right? Not if you’re a left winger!!!

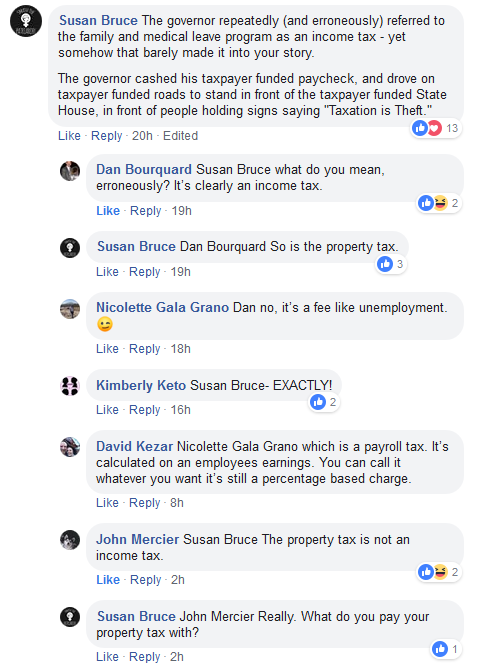

Susan Bruce, a left-wing blogger somewhere in New Hampshire, had the following discussion on the Concord Monitor’s Facebook page about a story regarding the ‘Preserve the NH Advantage‘ rally held over the weekend:

Not only did this literally make me *snort laugh* but I also did a ‘facepalm.’

I don’t even know where to begin with how ridiculous Bruce is by saying property tax (a tax levied on property you own) is an income tax. And claiming something is an income tax because you pay for it with your income is just…. well, it’s just flat-out stupid.

This is how illogical the left becomes when they cannot explain that the Paid Family Leave program ISN’T indeed a tax on a person’s income. It’s DIRECTLY a tax on their income. There are no ‘opt outs’ in Dan Feltes’ program. You will be forced to pay for this program whether you like it or not and whether or not you ever use it (unless your employer has an existing program that is ‘approved’ by the government *wink* *wink*).

Eliot Axelman at Liberty Block explains how this new government ‘welfare’ program works:

The program would be unsustainable as constructed by this bill (according to the New Hampshire Government Dept. of Employment Security) and would not function properly no matter which adjustments were made to it. Additionally, the program would involve redistribution of wealth from those who earn money to those who earn less money. The authors accomplished this by including language that calculates the tax by percentage of income but assures that the welfare benefit is not less than $125 per week or greater than 0.85 of the average weekly wage in New Hampshire (meaning that if your salary is greater than the 44th percentile of earners in New Hampshire, this program is socialist in nature, because it would use government force to redistribute your wealth).

Currently, employers must pay the State government payroll taxes whenever they pay any employee. This tax goes towards unemployment insurance, it seems. This new ‘FMLI’ tax would be added onto the unemployment payroll tax. This would inevitably result in employees in New Hampshire (other than government employees) earning 0.5% less money.

If the left in New Hampshire wants to argue FOR their Paid Family Leave program, they ought to at least tell the truth about it.

That they choose to lie instead (and yes, they are all lying about it) shows you just how BAD this legislation is for Granite Staters and the State of New Hampshire in general.