With the pandemic driven business shutdowns, New Hampshire is expecting enough of a drop in Business Enterprise Tax (BET) to trigger a tax rate increase under a law passed a few years ago. The BET is a tax on having employees.

We’d like to thank Jess Edwards for this Op-Ed. If you have an Op-Ed or LTE you would

like us to consider please submit it to either Skip@GraniteGrok or Steve@granitegrok.com.

The tax rate increase will cost businesses by as much as 12.5% during a global pandemic and economic recovery staring 1 January 2021. Republicans proposed freezing the tax rate at the current level for two years to make recovery a lighter lift for our businesses to rehire. The Democrat-controlled House Rules Committee rejected the Republican freeze proposal on June 3rd by a party-line vote of 6-4.

A few years ago, NH had one of the highest cost business tax environments in the United States. In order to stimulate business development and improve the employment that comes with it, Republicans proposed a set of tax rate reductions.

Since the Legislature operates under the general principle of “Pay as you go”, the question was asked, “What spending cuts will you implement since fewer revenues will come in?”

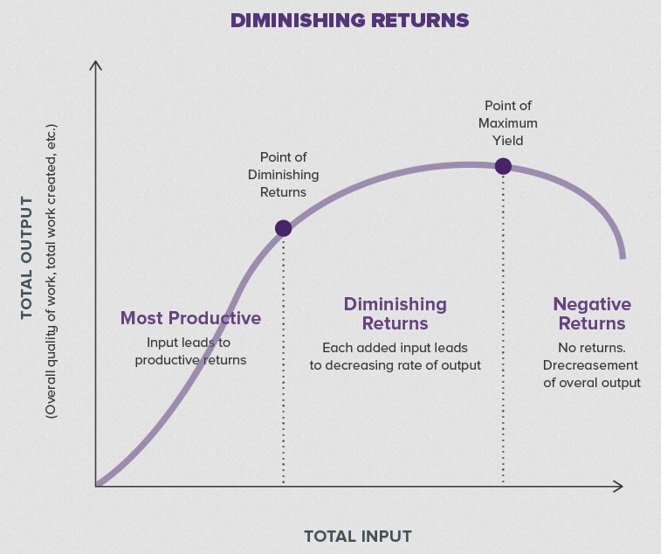

The Republican position was that our rates were so high, that they could be reduced a little bit and it would be stimulative, driving higher revenues from greater economic activity. The theory was the state was on the Negative Returns section of the LAW OF DIMINISHING RETURNS. If that position was correct, tax revenue would go up due to increased economic activity. This requires DYNAMIC SCORING meaning that reducing the tax rates may stimulate more economic activity and therefore raise tax revenues.

However, the state uses STATIC SCORING meaning that we assume all economic behavior has a direct correlation. It is assumed that all tax rate increases grow revenues and all tax reductions reduce revenues.

The Democrats rightly challenged the Republican majority to provide assurance that we wouldn’t be cutting tax revenues. We compromised and created the trigger to raise the rates if tax revenues went down more than 6%. Under normal economic conditions, we would have been right. Business taxes were trending along the plan until the shutdown.

However, we experienced the first-ever government-mandated shut down of the economy. For the only time ever in US history, the government explicitly and intentionally shut down major portions of the economy.

This scenario was not anticipated. Now it is upon us.

In this environment, its important to incentivize rehiring. The Business Enterprise Tax (BET) is a tax on having employees. If you raise the tax, you signal the business that it should hire fewer people. If you lower the tax, you signal that business should hire more people.

By way of analogy, when legislatures wanted to reduce smoking, they raised the taxes on cigarettes. When some legislatures (California) wanted to reduce driving, they raised the taxes on gasoline.

While I don’t want to believe that the Democrats intentionally wish to reduce rehiring and hurt more families, that’s where we’re at by raising the tax on hiring.

Now rather than look at the obvious implication of this tax rate increase, we’ve entered a political season. The General Election is about 150 days away.

NH State Representative Jess Edwards (R-Auburn) serves on the NH House’s Ways and Means Committee