We learned that Rep. Susan DeLemus (R-Rochester) has an incredible voice. She graced us all with a beautifully executed rendition of the Star-Spangled Banner.

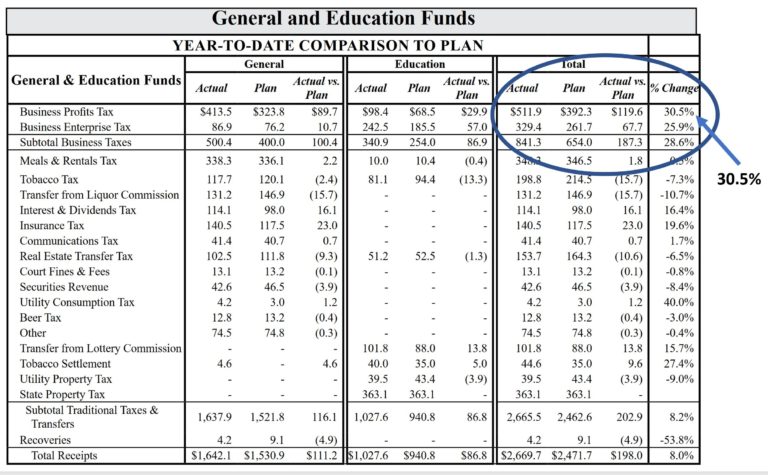

UPDATE II: Gunstock Mountain Resort – An RSA 91:A Demand – Payment of Taxes Information

Maybe one of these epochs, I’ll finally get caught up on stuff. One of those was about my RSA 91:A Right To Know, issued on August 5th, concerning taxes paid by Gunstock Mountain Resort (Business Profits Tax, Business Enterprise Tax, Meals & Rooms Tax) as well as the top shareholders in GMR and any monies … Read more