By Rep. Jess Edwards (R-Auburn)

The Business Profits Tax (“BPT”) was enacted in 1970. The tax was initially assessed at the rate of 8.2%, making NH one of the least attractive states in which to do business.

To improve our business climate, the BPT rate was reduced to 7.9% for 2018. The rate was further reduced for 2019 to 7.7%. These rate declines were done judiciously because revenue targets needed to be hit in order for the lower rates to go into effect. Under current law, the BPT rate will again be reduced to 7.5% for 2021.

The NH Democrats have opposed these rate declines and have falsely claimed that tax revenues would decline with the rate reduction. With their newfound power in the 2019-2020 term, they have sought to restore the higher rates. After resistance by the Republican minority, their goal shifted to “freezing” the rates at the 2018 level of 7.9%.

Given that the current 2019 rate is 7.7% and businesses have already paid estimated taxes at that rate for the first two quarters of the year, NH Democrats are fighting for a retroactive tax increase that would cause small businesses and job creators to write unbudgeted checks to the state of approximately $22.5 million to cover the first six months of 2019 with another $22.5m for the second half of 2019. That’s $90m more over the biennium.

In addition, the Democrats also propose to repeal future tax reductions in current law.

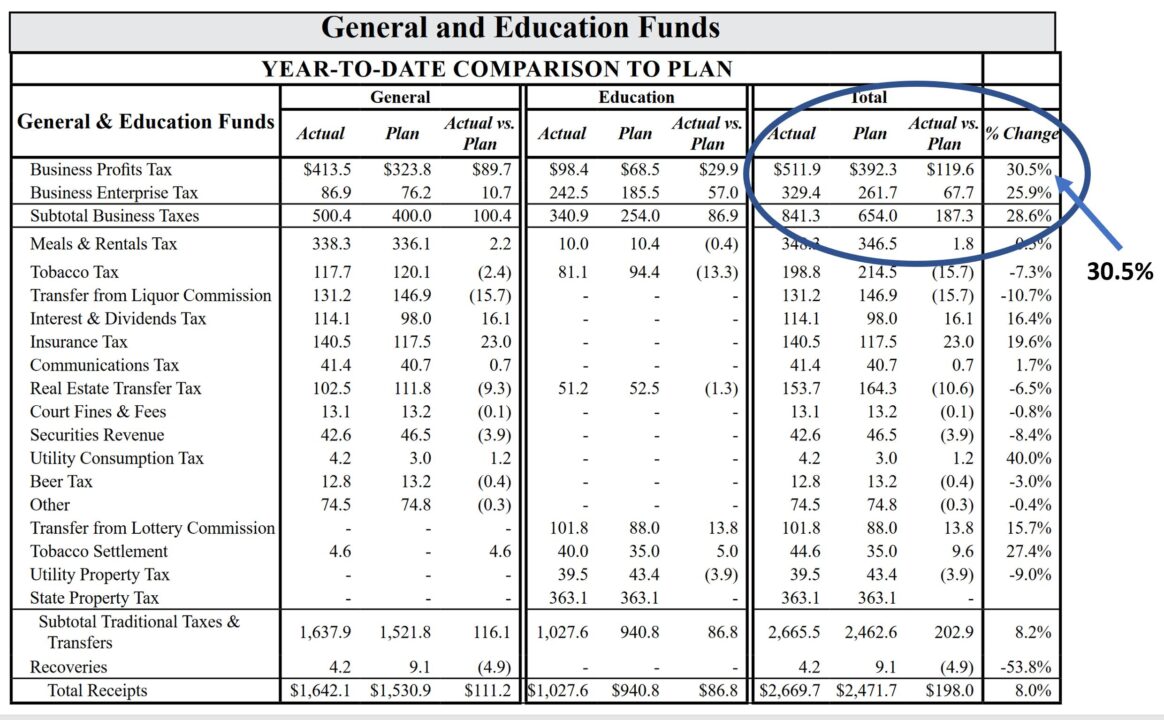

This retroactive change in state tax policy completely disrespects our business owners. It might make sense if we were experiencing a fiscal crisis due to an unforecasted decline in tax revenues. However, the reality is extremely positive with the BPT coming in over THIRTY PERCENT (30.5%) above plan (see above chart).

Now to be fair, correlation is not the same as causation. Those that have been advocating since before the last election to raise the BPT rates can rightly point out that there are a great many factors beyond the tax rate that influence total tax revenues. For examples, federal tax and regulatory policies are key drivers for state collections.

What we know is that the NH Democrats who campaigned in 2018 on raising the BPT rate to get “needed funds for vital projects” were wrong. They were wrong in the gloom and doom view they shared with voters that tax revenues would decline. BPT revenues went up 30.5% after all. It’s noteworthy that despite being wrong before, they still want to raise the rates. It’s as if “When in doubt, raise tax rates” is one of their governing principles.

We should not retroactively raise the BPT rate. The Governor needs to remain firm during these budget negotiations.

Common sense has taught most of us that you shouldn’t try to “fix” something that isn’t broken. Common decency informs most of us that you don’t retroactively raise taxes unless it’s a last resort.

Rep. Jess Edwards (R-Auburn)

Ways and Means Committee