The federal government drools when it come to budgeting

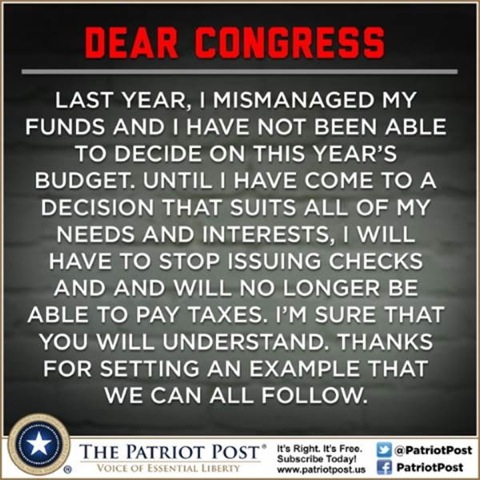

The federal deficit was $693 billion for the first half of fiscal year 2019. That is $94 billion more than the deficit recorded during the same period last year. By anybody’s numbers the deficit and our accumulated debt are too large. Quite simply our federal government has stopped budgeting. It is content to simply continually authorize additional spending. The federal government writes checks which it knows it cannot cover under the assumption it will be able to borrow enough to cover the checks. That is irresponsible.

The Congressional Budget Office (CBO) breaks down the source of the deficit. They divide between reductions in revenue and increases in spending. Total receipts are actually up by $9 billion. So actually there wasn’t a drop in revenue… which means there was no actual tax reduction because we actually paid more of our money into the government. Think about that for a minute. Just let it sink in. At the same time, spending is up $103 billion. That nets out to an increase in the deficit of $94 billion. So the issue is, drum roll please… uncontrolled SPENDING.

So let’s play what if…

Now, what if the tax “cut” hadn’t been enacted? Then revenue would have been higher and the deficit would be lower? Absolutely true, but it’s just not right. Here’s why. You see the difference wasn’t an amount big enough to be meaningful. CBO also breaks down changes in revenue and spending by source. So according to the latest numbers, individual income and payroll taxes together rose by $14 billion (or about 1%), while corporate income taxes fell by about $11 billion (or about 15%). Revenue from other sources resulted in a net increase of $7 billion (or about 6%), mostly because of increased excise taxes and customs duties.

Said another way, even if corporate taxes remained unchanged from last year, and even if Trump’s trade war didn’t offset the tax cut with extra revenue, tariffs are taxes, the deficit would have been reduced by $18 billion. Revenue from income taxes could have been up by more, too, without the Tax Cuts and Jobs Act (TCJA), but it’s a tough case to make, that revenue is to blame when total receipts are already higher than they were a year ago. We did reduce the tax rate. The result was total tax revenue went up.

One might insist, the economy is strong right now, so of course revenues won’t be down by that much. This line of reasoning is problematic if we remember that CBO is measuring revenues relative to where they were at this time last year. So, for that argument to hold water, you’d have to believe that the economy is even stronger now than it was a year ago. But why would anyone believe that, unless you think tax cuts are spurring additional economic growth and associated revenue.

There’s wrong and then there’s really wrong…

The idea being pushed, that this current time of skyrocketing deficits is being driven by tax policy is not just simplistic; it’s flat-out wrong. Ignoring the fact that deficits are mostly a result of spending increases, not tax cuts, can be a compelling way to temporarily avoid hard discussions about spending cuts.

When anyone brings up desperately needed spending reform these days the conversation instantly shifts into a discussion about tax policy. This is all under the false notion that tax adjustments can get us out of the situation in which we find ourselves.

Conclusion:

Whatever you feel about the tax cuts, the numbers don’t lie. Spending is and will remain the root of the problem. The deficits will rise until law makers summon the courage to get spending under control. That’s the truth and it’s time we deal with it.