New Hampshire Democrats have a love-hate relationship with property taxes. They love taxes and taxing property, but they hate it when property taxes are the primary source of revenue and the total tax burden is incredibly low.

Tax Burden

New Hampshire Has One of the Lowest Overall Tax Burdens in the Nation (Again!)

The New Hampshire House just cut some taxes. Whether the Senate and governor will concur remains to be seen, but while we wait, chew on this. Despite having a high property tax burden, the Granite State has one of the lowest overall tax burdens in the nation (again).

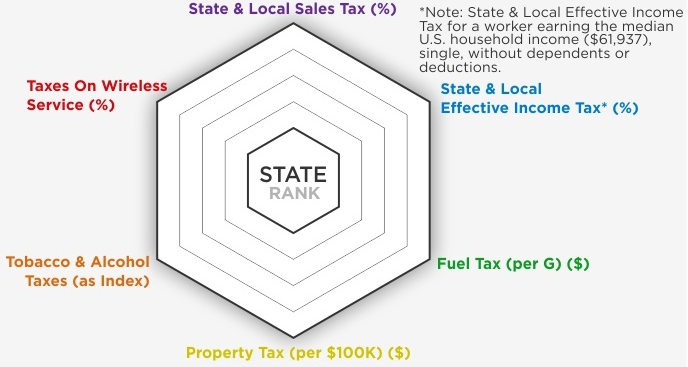

Data Point – Best and Worst Taxed States

While NH Progressives focus ONLY on property tax, in New Hampshire the overall tax burden is always one of the lowest in the nation. But Democrats never, EVER want to talk about that.

Benefits of a Principled Tax Burden

Is there such a thing as benefits of a principled tax burden? If there were; what would they be? Fact: taxes lower the economic welfare of citizens.

NHBR Bemoans NH’s High Property Taxes but Ignores What That Means for Total Tax Burden

When the New Hampshire media reports on our state’s reliance on property taxes you always hear how they are “some of the highest in the nation.” It’s true. Why don’t these same media outlets note, in the same breath, that this might be why our total tax burden is one of the lowest in the nation?

Public Pension Liabilities

Let’s talk about public pension liabilities. This is something important to young and old alike. Why? Because of what is called unfunded liabilities. Almost no one is paying attention to unfunded liabilities in our public pension system.

Carbon Tax… Bad

Carbon tax bills are the talk in DC these days. There is marginal bipartisan support for enacting a new tax. Enacting a carbon tax will impact American families and businesses. Bipartisanship doesn’t make it good policy. A principled tax system is the way to promote prosperity for its residents. It should advance a government’s economic … Read more

The Rising Tax Burden in America

Conservative commentator Rachel Alexander joins us to talk about taxes, rising tax burden, the Obamacare fine, Bernie’s tax-utopia, and our tax future.

Report Claims: Manchester NH one of Ten Least Taxed Cities in US

There is a good deal of couched language in this article, but a few things stand out. According to Edward Wyatt, fiscal analyst for the Office of Revenue Analysis, while tax rates are certainly a factor in the tax burden on families, it is more the existence of certain kinds of taxes that determines whether … Read more

It’s A NH Democrat Bill Kennedy Kind Of Morning…This Time It’s About Tax Burden

Bill is probably a great guy, and I’m sure he never meant to violate Department of Defense regulations by posting images of himself in uniform on a campaign web site. But that’s not the only thing that caught my eye while I was there. Bill is also guilty of lying by omission.

Bill is probably a great guy, and I’m sure he never meant to violate Department of Defense regulations by posting images of himself in uniform on a campaign web site. But that’s not the only thing that caught my eye while I was there. Bill is also guilty of lying by omission.

You see, while claiming to be something of a centrist, he still suffers from the same illness as the majority of Democrats in New Hampshire when it comes to talking about taxes and tax burden. On the same page in which he violated DoD regulation 1344.10, he also engaged in partisan hackery when he says…

“NH is ranked 2nd or 4th worst (depending on whose statistics you use) for property tax burden.”

By using the word tax BURDEN, we are meant to presume a horrible thing but every tax is part of that burden. If we are going to have an honest discussion about tax burden, shouldn’t we talk about total tax burden? And why, despite Bill’s sound bite-which is accurate by the way– New Hampshire still has one of the lowest overall tax burdens in the nation?