New Hampshire Democrats have a love-hate relationship with property taxes. They love taxes and taxing property, but they hate it when property taxes are the primary source of revenue and the total tax burden is incredibly low.

They complain endlessly about high property taxes as if they are interested in lower taxes when what they want is to convince people to let them tax them more by other means. We can see that process everywhere in New England and much of America.

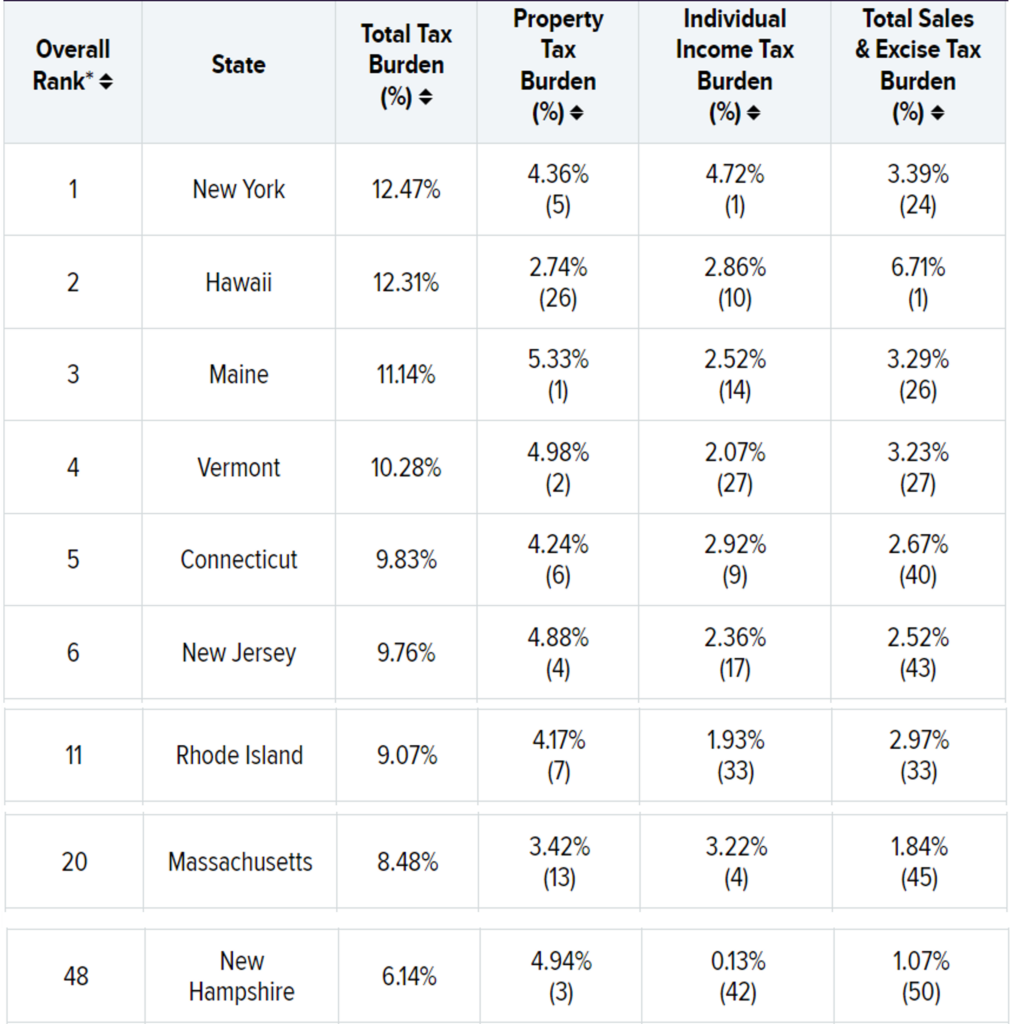

New Hampshire is ranked 48th out of 50 states for America’s lowest total tax burden. Only Deleware and Alaska are lower, and New Hampshire is poised to pass Delaware. The Granite State has eliminated its Interest and Dividends tax effective the end of next year.

Regionally, New Hampshire has a lot of Demcorat-run neighbors, all of whom – regardless of the story they tell about the property or taxes, rank a bit higher for tax burden than the Granite State.

Democrat-run Maine and Vermont already have higher property tax burdens, Democrat-run New Jersey is close, and the others, all Democrat-run, are taxing more in places you are less likely to notice, and that is key because it is what they do no matter where they do it.

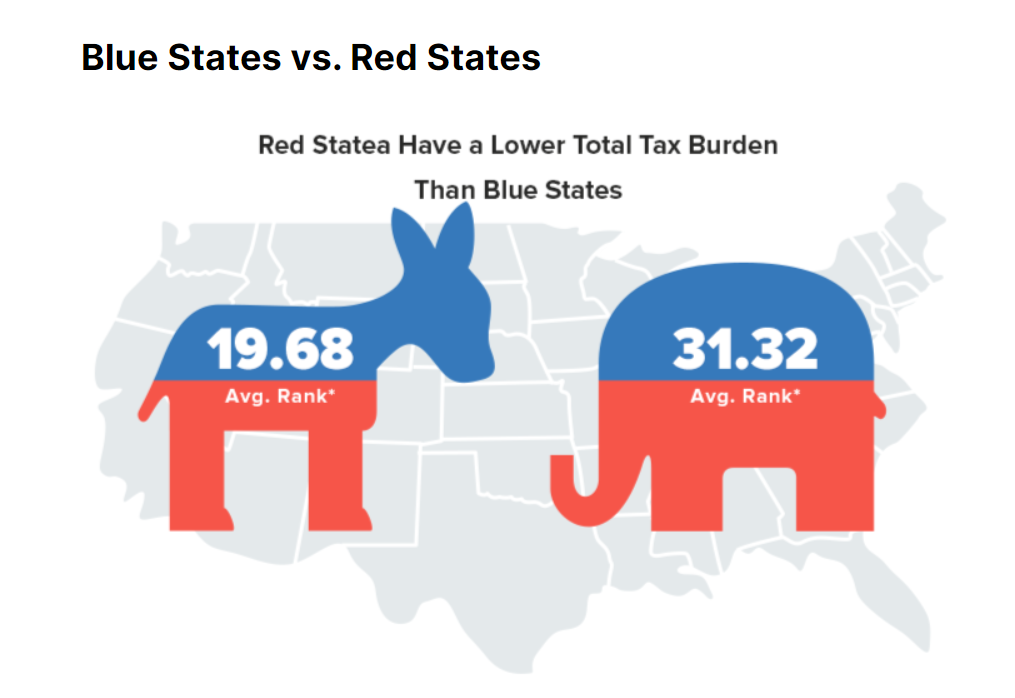

Democrats, the party of more government, must always raise taxes. They never lower them. Failing to raise them is peddled as cutting the budget. There is no scenario where they will not demand more which they get – in most cases – by lying about projected revenue, spending it, and then claiming they’ll have to cut programs if we don’t fund the things for which we never had money in the first place.

Property taxes can never go away, and any initial decline or promise of such is always a head-fake. Once they get the new taxes and the bureaucracy to collect them, they will be back – and in New Hampshire, there’s no guarantee any state-level reimbursement won’t get spent on top of the property taxes they collect now. You can bet it will, and you’ll have new taxes and be on the hook for more.

Democrats do not hate the property tax because it burdens working families; they despise it because it is visible.

You get a tax bill twice yearly (in New Hampshire) and can’t mistake the meaning. The government is taking these many thousands from your pocket, and you might want to know why or for what.

New Hampshire’s property tax is transparent. That is what the Left wants to end, and everywhere they do that, the people end up with a higher total tax burden.