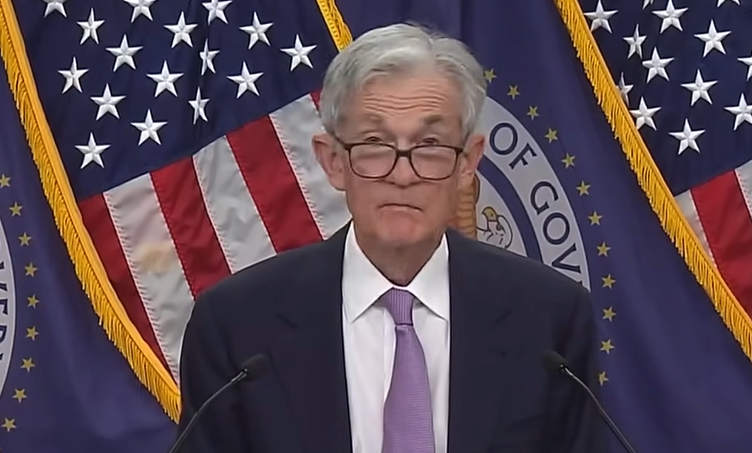

By hiking interest rates, the Federal Reserve has pulled some of its monetary stimulus out of the economy. While the Fed hasn’t done nearly enough to put the inflationary fire it lit with more than a decade of easy money, cooling consumer price index (CPI) indicates that this has put a modest dent in price inflation — for now.

PAYNE: The Euthanasia of Capitalism

Among several comments responding to my October 7th OP-ED called the HIGH PRICE OF TYRANNY, were the words: “There is no $37 trillion debt. When you understand the Federal Reserve, then you might understand those words. Until you learn that, you should be quiet.” At my age, I like to learn, but have no intention … Read more