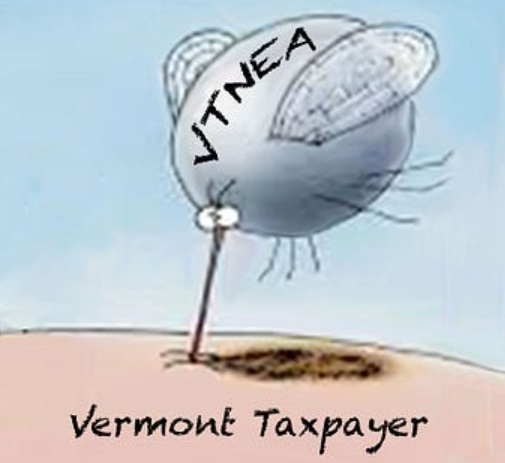

In 2024, when Vermont property taxpayers were whacked with an average 14 percent year over year increase, with some communities seeing nearly 40 percent increases, nobody (or at least not enough) in the legislature asked if citizens could afford this. They just shrugged their shoulders and stuck us with the bill. Same as every year when the public school system increases its spending at rates higher than inflation and higher than income growth, the response from our politicians is, to steal a line from Goodfellas explaining how the mob works, “[Expletive] you, pay me!”

How about for this year, let’s not do that. No more. Time to put the needs of household budgets first.

For the last year-plus of this latest education reform debate, we keep hearing that it is just impossible for our schools to deal with any cuts to their revenue. It would be so unfair to expect them to have to make difficult spending decisions, or, heaven forbid, work harder or more hours to make ends meet. And this has been the story for more than just the last year and a half, it’s been the story forever. Or at least the last twenty-five years since passage of Act 60.

So why, I ask, can nobody in elected office apply the same compassionate reasoning to the budgets of the people who, you know, elect them! Where are the Representatives and Senators who stand up and say, it’s just not fair to expect working people to take a several hundred or few thousand dollar hit to their limited disposal income — again! Where are the politicians who will stand up and say we need to put these tax increases off for two or three or four years in order to give the people we’re handing the bill to time to prepare? Where are those who will say the taxpayers have paid their fair share — and more than their fair share — for too long, and now it’s time for the system to give back.

What do they think happens to household budgets when a massive tax increase or a brand-new tax lands? Any tax increase is a cut to someone’s after-tax income requiring cuts to household budgets. Maybe that means no family vacation this year. Maybe it means cuts to retirement or college savings plans. Maybe it means cutting spending on food, or heat, or medical care. Maybe it means having to take a second job. Whatever, it means households have to make hard decisions about how to get by with less money – money that they earned — to spend. And families have been forced to figure out this painful math every year, year after year.

So, serious question: why can’t our public-school bureaucracy be the ones figuring out how to do as much or more with less this time. Just once. Your turn! Tag, you’re it!

It’s not as if our public schools can credibly cry poverty. We now spend more money per student than every other state but possibly one. $2.4 billion (and more every year!) for 80,000 kids (and fewer every year!). They are rolling in our dough.

It’s not as if our public schools can make the case that they’re delivering superior results with all that money we’re forking over. Outcomes in almost every category across all tested grades are dropping and have been for at least a decade and a half. The folks in charge of our public education systems are, generally and statistically speaking, not good stewards of our tax dollars or our children. Rewarding them with more money every year is not working. Maybe forcing them to think and act more efficiently will be the kick they need to do a more competent job.

Oh, but it’s for the children! I’ve got news for you: kids spend more time at home than in school — and home is more important. Forcing cuts to household budgets as the result of confiscatory tax increases does no favors for children. Creating money problems for parents is not good for kids’ material well-being or their mental health. Anxiety over whether or not you can remain in your home because of a tax bill your parents can’t afford to pay is bound to take a toll. Fighting over money issues, parents having to spend more hours working and apart from kids to cover costs, less money for things that make home more comfortable and secure – none of this is good for anybody, especially kids.

So, when the legislature returns to the State House on June 16th for one more bite at the H.454 education reform apple, please look at what you’re doing from the average Vermont taxpayer’s perspective, base your decisions on how they will impact our household budgets, and remember you work for us. And when the lobbyist for our bloated, overpaid, underperforming, unaccountable public education bureaucracy insists they can’t possibly do with less, remember and reply with that Goodfellas quote above. If we could be expected to take a 14 percent hit last year, they should be able to take a cut this year. That’s fair.

Agree? Disagree? Submit Op-Eds to steve@granitegrok.com – We want to hear from you, too!