By creating an inflationary regime via policy (I blame Biden and his Socialist/Communist minions for this problem), the Fed’s predictable response is to start raising interest rates – a major factor for just about every small business.

That often ends in declaring bankruptcy.

Reformatted, emphasis mine.

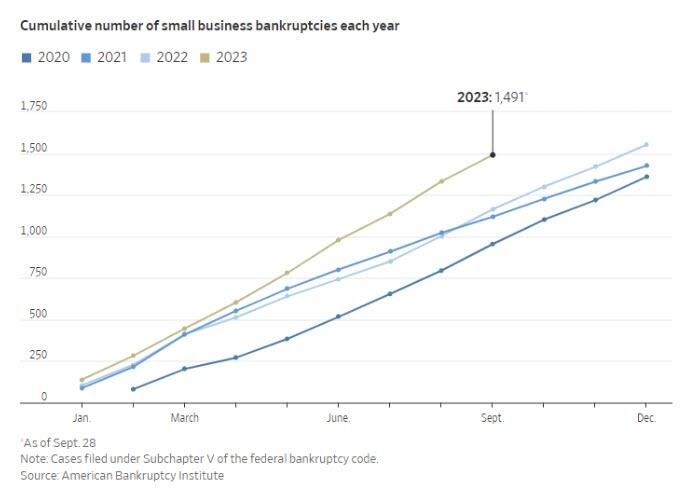

…Nearly 1,500 small businesses filed for Subchapter V bankruptcy this year through Sept. 28, nearly as many as in all of 2022, according to the American Bankruptcy Institute. Bankruptcy petitions are just one sign of financial stress. Small-business loan delinquencies and defaults have edged upward since June 2022 and are now above prepandemic averages, according to Equifax.

An index tracking small-business owners’ confidence ticked down slightly in September, driven by heightened concerns about the economy, according to a survey of more than 750 small businesses. Fifty-two percent of respondents believed that the country is approaching or in a recession, said the survey by Vistage Worldwide, a business-coaching and peer-advisory firm.

…“We are just at the front end of the impact of these dramatically higher interest rates,” Gonzales said. “There are going to be plenty of small businesses that are overleveraged.”

- Five Reasons for Surge in Bankruptcies

Rising Interest Rates

Surging Wages

Tighter Bank Credit

Overleverage

Work-at-Home Curtailing Demand

S0, who was correct? Is the Right for skewering “Bidenomics,” or is Biden for trying to own “Bidenomics” and take control of it away?

Can you say “Backfire”?

HT | ZeroHedge

Support Independent Media – Please Scan the QR Code or Use the embedded form to get your tickets to Groktoberfest!