While I was on my town’s Budget Committee, I warned the town and school board against taking “free money” that the Feds were giving out like the candy thrown out by Old Home Day marchers. The analogy was apt.

The kids along the marching route eagerly went after the candy just lying in the street while department heads and town leaders pursued any and all money that the Feds were throwing their way. No difference at all – one having the lure of sugar, the other nothing but sugar – both addictive, but at least the kids had [more] responsible adults in charge of them to limit their access to that “free” stuff.

My warning was that the “money candy,” like the candy on Old Home Day, would run out. You can only hand out free stuff for so long before the bills come due.

That was when the national debt was between $4-$6 Trillion.

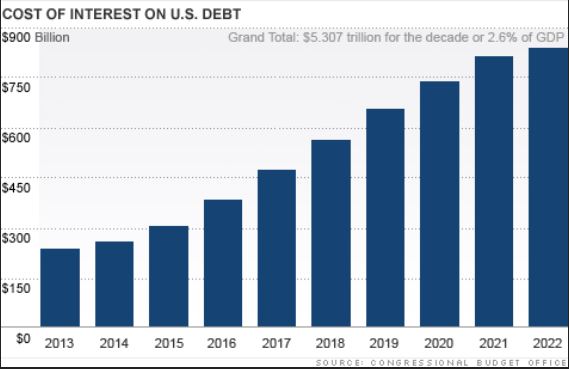

Such a trite and quaint idea it was, telling them that too much was too much. Telling them that the cost will come due and you all won’t like it. I told them that all it would take would be the rise of 2-4% points in interest rates, and just the interest payment on the national debt (forget about principal payments) would soar. Well, guess what: now those financial chickens have come home to roost.

The Congressional Budget Office on Monday revealed that the cost of payments on the federal debt soared 41 percent in the first six months of the fiscal year thanks to higher interest rates — driving the deficit up to $1.1 trillion over the period.

…The Federal Reserve Board has pursued an aggressive rate-increasing campaign to try and tame inflation, but one of the risks was always that this would further exacerbate the nation’s fiscal problems by adding to the cost of interest payments on the debt.

…In February, CBO projected that by the end of the decade, the federal government would spend more on interest payments than on defense.

Only an optimist would hold that it would take until the end of the decade to hit that point (defense spending will be $816.7 Billion this year) but is also dwarfed by Welfare, Social Security, Medicare, and unemployment compensation ($4 Trillion). Just interest payments on the National Debt are projected to be $308 Billion this fiscal year. And that’s ONLY IF:

- Interest rates don’t go up further.

- The yearly deficit doesn’t continue to rise – but it is.

- And that the Dollar stays as the world’s reserve currency

Just for the first half of this fiscal year, the deficit has gone up $1.1 Trillion already. The second half, I bet, will be larger.

As we have seen, we haven’t had enough responsible adults either in Congress, in the Federal Reserve, in the Executive Branch, or in voters to have seen this three-decade man-caused disaster coming like a slow-moving train wreck. And stop it.

We’ve become far too greedy as a nation – we spend far too much on far too many things that, at the Federal level, we shouldn’t be spending at all.

Oh, to Point #3?

Gross interest owed on the $31.4 trillion national debt—that is, interest owed on both the $24.9 trillion publicly traded debt and the $6.7 trillion debt in the Social Security, Medicare, and other trust funds—will reach a gargantuan $1 trillion in 2024 for the first time in American history, according to the latest data gathered by the White House Office of Management and budget.

While Biden wants to jack up the Federal Budget north of $7 Trillion this year, it nominally has been around $4 Trillion the last few years. So 25% will be for debt payment.

We’re screwed.