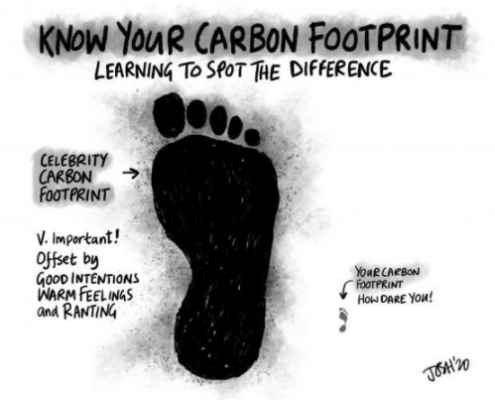

One thing more accurate than any other when talking about the climate cult is emissions offshoring. Specifically, ignoring the carbon production required elsewhere to ‘Green’ up (on paper) here. But it also applies to the activity exerted in the name of forcing others to bow before the same alter against their will.

As I’ve noted often, and just yesterday,

“It’s ixnay on the environmental ostcay of wind, solar, EVs, recycling, or reusable shopping bags. These chapter-and-verse solutions have the climate cult equivalent of papal dispensation. The result is trillions of US dollars to China, the world’s largest polluter, so American progressives pretend they are saving the air and water.”

A bank in Australia is a shining new example of this. Banks already track credit card transactions, but this one has aligned itself with a third party to calculate the carbon footprint of everything you spend money on (not including bank fees, I imagine). The goal is to guilt you into doing less because they are convinced (or telling you they are) that the planet is doomed, and this will help.

A person’s carbon footprint is calculated and then an ‘equivalent’ metric is show to make the customer feel guilty about it, such as “8 trees being cut”.

“By combining our rich customer data and CoGo’s industry-leading capability in measuring carbon outputs, we will be able to provide greater transparency for customers so that they can take actionable steps to reduce their environmental footprint,” CommBank Group executive Angus Sullivan said in a statement.

The bank has promised to refine the calculation down to showing how much CO2 individual purchases are responsible for.

It’s also why they want a cashless society. It is easier to control you, and that’s the real goal. Limit your choices and freedom. Force you to do with less while the bank emits all it wants or pretends that buying offsets beyond the reach of almost everyone else.

At some point, the process will include tracking your movements to add that cost to your carbon footprint. Someday, if you emit too much, you will be billed or charged or fined or something.

Australia’s Commonwealth Bank (CBA) has partnered with Cogo, a “carbon management solutions” company, to launch the new feature, which is part of CBA’s online banking platform.

The bank gives the customer the option to “pay a fee” to offset their carbon footprint, with the average listed as 1,280 kilograms, a long way from the ‘sustainable’ figure of 200 kilograms.

But nowhere do they mention how much carbon they emit to do all this surveillance and back and forth on top of existing operations.

At the most superficial level, most of the components, network infrastructure, and electronics they use will have come from China, where they burn dirty coal to keep prices low. Not just the servers but the wireless technology. Those systems need to be operated, supervised, contained, and maintained by people who are emitting carbon to do that. I find it unlikely that the total carbon costs are insignificant and that its absence would not be better for the environment if that were the goal.

The Commonwealth Bank of Australia (CBA), or CommBank, is an Australian multinational bank with businesses across New Zealand, Asia, the United States and the United Kingdom. It provides a variety of financial services including retail, business and institutional banking, funds management, superannuation, insurance, investment and broking services. The Commonwealth Bank is the largest Australian listed company on the Australian Securities Exchange as of August 2015 with brands including Bankwest, Colonial First State Investments, ASB Bank (New Zealand), Commonwealth Securities (CommSec) and Commonwealth Insurance (CommInsure).

It is not the goal. Being an oligarch in the NWO is a Goal, and the NWO wants control of everyone. Control is the goal.

Oh, and they have a branch in the US.

The New York branch of the Commonwealth Bank was established in 1977. The branch has dedicated infrastructure and utilities, and natural resources teams to develop capital solutions that suit clients’ needs. The branch also offers a range of global market services including foreign exchange, interest rate derivatives, commodities, fixed income products, money market services and private placements.

On our doorstep and all that, yes?