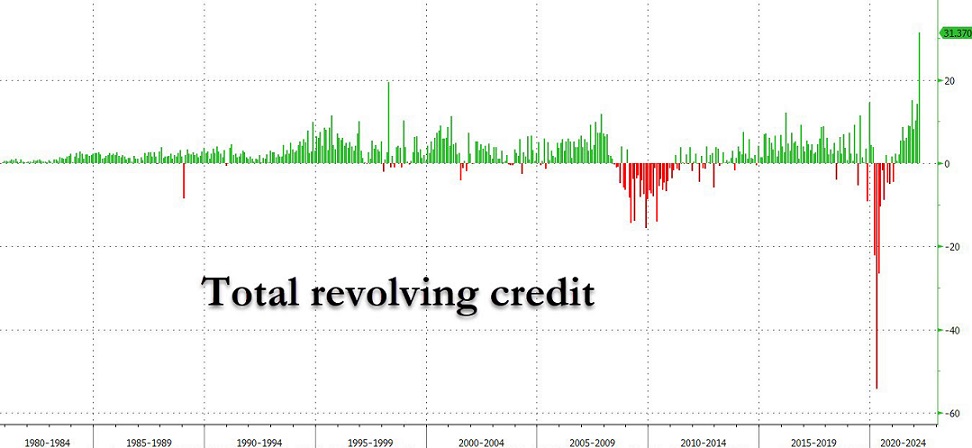

Forget CPI: the week’s most important data point is today’s monthly consumer credit update. Last month we saw a blowout, record surge in credit card usage as consumers tapped out…… and sure enough it was, while again confirming what we have been saying for month: any excess savings accumulated by the US middle class are long gone, and in their place Americans have unleashed a credit-card fueled spending spree.

Click to embiggen.

While it is traditionally viewed as a B-grade economic indicator, the April consumer credit report from the Federal Reserve was another shocker especially after last month’s stunning surge in credit card debt which saw the biggest increase in revolving credit on record which is why we said that today’s G.19 print straight from the Fed would be just as important as Friday’s CPI print…

Living on a fixed income during high inflation is not easy – but we are doing the opposite of most. I lived through the Carter years and then the Reagan years and I know it will HURT just from the financial side to get through this deliberate and planned chaos that the Obama retreads and Davos Elite are putting us through – America Last. Finances, inflation, energy, food, basic good, healthcare (we just ran around the last couple of days trying to find the Grandson’s medications that, all of a sudden, can’t be found. We finally did, today).

ALL of this is government inspired and I am convinced that this isn’t by accident or stupidity. Brace yourselves, folks, this is not just a “bumpy ride” coming at us.

If you are one of those using the cards to maintain your standard of living, STOP IT NOW! Lower it and and don’t finance it if you possible can. Discipline is going to be the watchword gong forward.

And if you really need to be persuaded of that advice, just click on the link below and be prepared to be shocked.

(H/T: Zero Hedge)