Inflation is the short way to say “sacrificing the dollar”. It is Government’s way, via monetary policies, to pay existing debt with dollars that are worth less later.

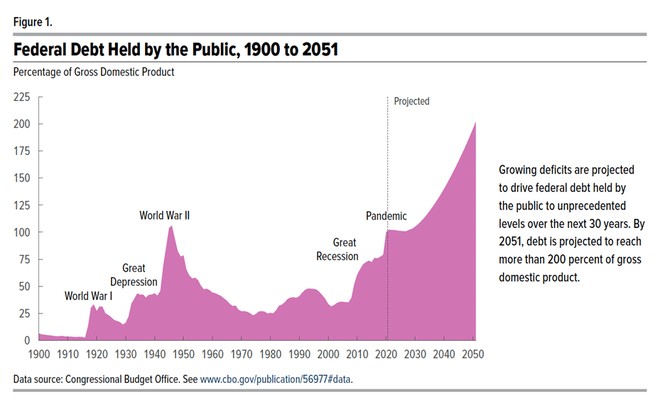

Assuming that the CBO’s outlook is right about growth potential, our fiscal future might look like this:

Most of the scariest stuff is to the right of the “projected” line at year 2020 — which means it’s something that might happen — but that leaves a fair amount of frightening mauve in the already-happened period from 2008 to now.All of this also assumes no big spike in interest rates. This is based on Goldilocks-like interest-rate assumptions, which means that it has embedded into it continued debt monetization. If the Fed doesn’t play ball, the interest portion of debt services will kick in a lot faster. The Fed has already signaled that it will act to rescue America from the American Rescue Plan Act both by keeping its target rate low and by indicating in its most recent meeting that it intends to continue to do so. Given the rising importance of interest on the national debt, it’s unlikely that they will fail to rescue us (and our good faith and credit) from future fiscal-rescue attempts. And the only way they can rescue interest rates is by sacrificing the dollar.

And who does this hurt? The middle and lower classes whose level of income may not expand as fast as inflation – meaning that their standard of living will tank.

I remember, coming into my adult life when inflation was double digits. It didn’t matter to me as much as others having just come out of college, no house, no real expenses, and no family to worry about. Just me and in an industry before the disruptive event of the personal computer ruined the mini-computer (DEC, WANG, Data General) market in which I was currently working.

There was a home sellers’ bull market then, too – in that Rte 128/495 ring and home prices were skyrocketing. One friend saw her home rise 20% in one year. And just like in the mid-2000s until the boom fell off the cliff in 2006-2008, they were re-mortgaging their home to take cash out.

Free money, so it seemed, until the bust came and those home values that rose so, fast died so quickly as well.

That lesson was one I learned – inflation can both help and kill you. Bought my two homes (been here 36 years) and never played that game. Didn’t get into trouble, either.

But there will be those, even with the last runup just a decade + ago, there are those that are going to get nailed.

I often said at BudComm meetings that we shouldn’t be taking State and Federal money on a regular basis.

Sidenote: Silly me – I kept telling them, at just $7 Billion of Federal Debt, that if interest rates go up, there’d be no money coming back as Fed money would then be throwing money at interest payments. Now we’re headed on a runaway fiscal train towards $30 Trillion.

Don’t get used to that “free money” always coming in because if interest rates start jumping, it wouldn’t be coming to town. This chart is bringing the long and old prediction to the fore. Still, its a bit out there but if this current nonsense of Modern Monetary Theory keeps getting used in practice, we’re screwed.

(H/T: Finance.Townhall)