This is a long post so IF you don’t have the time, scroll down to “SECOND START” and read from there. You’ll get a good analysis of how Andru Volinsky’s march towards a complete State of NH takeover of educational funding will affect you.

First, a short snippet about the LA teachers strike to set the stage (reformatted, emphasis mine):

Let’s begin with the makeup of the school district: It boasts a $7.52 billion budget and more than 60,000 employees, including about 26,000 teachers, with the average annual salary being $73,000. While employment has gone up 16% since 2004, enrollment has dropped 10% in the same period.

Who’da thunk it? Union employment up, thus the costs are up, but student enrollment is down. More up than down. Same as we have here in NH (even if writ small compared to the LA district). There can only be one translation for this situation: “It’s for the teachers, not the children“. More and more for more teachers and administration, less for lesser number of kids”.

According to the latest available data, California school funding surged by nearly 10% from 2015 to 2016. If you examine a five-year period (2011 to 2016), school funding in the state is up a whopping 26%.

And yet, it’s never enough to feed the Edu-Industrial Complex. EVAH:

Governor Gavin Newsom (D-CA) has further proposed the “largest ever investment” in the LAUSD. Plus, the district already offered LAUSD educators a pay raise of 3% this year and another 3% in 2020. It was rejected.

Better pay raises than those that pay for those raises – rejected. And we have the Ring Around The Lake double-tap by the local school unions all saying “we need raises because that town over there get paid more” and we see the non-stopping Ring Around Rosey The Paycheck Size” – with the threat of “well, teachers will go elsewhere”. And the politicians here as well there keep falling for it. Why? The “schoolies” vote each and every time for their own benefit(s). It’s always a solid block of votes and the Democrats know it – and rely on it. It’s part of their collective of disparate special interest group war-gaming: we all vote for your interests but then you have to vote for everyone else’s. Hey, as long as you get what you want, why not?

And the taxpayers keep paying and paying and paying because they get outvoted every time. Who is there to protect THEIR interests? Not the Collective, fer sure. And it will continue until it is no longer sustainable.

But the school district can’t afford another pay hike. Next year, LAUSD will have a $422 million budget deficit, mainly because employee pension and health care costs represent a great portion of the budget – they will account for more than half within 10 years. Overall, it has $5.1 billion more in liabilities than in assets and another $15 billion in unfunded health care benefit liabilities for retirees and current workers.

And here in NH, we have similar situations. I’ve written about Nashua’s lament about not being able to offer the services they believe they should because their pension costs are too high. It seems that every town has now noticed “crap, this is getting out of hand” and I can’t WAIT for the Preference Cascade to trigger when taxpayers start realizing “hey, I’m not the only one thinking this – that I’m mortgaging my kids future by continually voting for this nonsense”. Wait for it to really happen when they realize that THEIR standard of living is being impacted a lot to raise that of their employees… and start to really think:

Who works for whom?

Congratulations, Nashua (et al) – you’re only a couple of decades behind California where town after town has had to go into bankruptcy because their allowed their labor costs to get too high over the long term. Politicians got the public sector votes, the public sector personnel got the high salaries, and the taxpayers are stuck with tons of pensions where the retirement costs are often well over $100K (and sometimes much more). They can’t fix their street, they can’t have the police to patrol them, can’t have the firemen to put out the fires, and well, can’t have the teachers. And the list goes on.

They’ve spent themselves into oblivion.

SECOND START:

Of COURSE, Nashua blames “downshifting” by the State (as if that would solve their financial problems) along with everyone else. The locals hate the idea that they should pay for the consequences of their decisions. Frankly, the State ought to get out of it altogether. Sorry, but the REAL problem is that you promised too much to public sector workers – the Politically Incorrect answer is that the salaries you give are too high. Simple.

Enter Stage Left – Andru Volinsky. He’s currently a NH Executive Councilor (and a rabid anti-Christian religious bigot – his words and his actions, not mine) and was the progenitor of the Claremont decision here in NH twenty odd years ago that caused the NH Supreme Court to redefine the word “cherish” to mean that the State is going to be financially responsible for equal outcomes educationally. Even for towns that spent decades mismanaging their themselves in making their towns unattractive to developers that would help enlarge their tax bases. So we ended up with a State wide property tax and endless political wrangling over “who else pays for MY children?” already knowing they want someone else to carry that load. He legally engineered what I’ve been saying for years: Progressives can’t stand that people (or in this case, towns) who make bad decisions end up with bad consequences. So, they socialize those bad consequences to the rest of us. And make no doubt, he’s quite the socialist style Progressive and he means to really show it this time. Read further to see how it wants to stick it to YOU.

Volinsky gave the latest speech of his road tour to get even MORE money from others last night in Belmont. I was hoping to go and record it but TMEW started to show the signs of the creeping crud illness that’s going around so I had to stay home to watch the Grandson.

But someone else did – someone with a long financial background that I can’t match along with a viewpoint that I wouldn’t have thought of; permission was given to put it onto the ‘Grok (emphasis mine):

I attended the NH School Funding Forum by Andru Volinsky held in Belmont along with other folks from town.

The gist of the lobbying campaign (11 regional meetings held by the lobbying team since 6/18) is that due to differences in economic fortunes across NH towns, the tax rates needed to fund a “constitutionally mandated quality education” is vastly different, the result of property values being different in “rich towns” vs “poor towns”. As such, educational fortunes are not equally distributed. So, the campaign seeks to enact a state law that taxes all towns for the average cost of a state education to ensure poor towns see a massive reduction in school taxes, while rich towns see a huge increase.

To attain their objective of all towns paying a equal education tax to fund an “average cost of education/student”. This tax would be somewhere around $14.50/1000 of property value for every household in the state. [This number was given to me after the presentation by their numbers cruncher] In return, the payback to each town/regional school system would be $15,865/student enrolled in the town.

$15K per child. No wonder the unions are fighting hard to derail parental school choice here in NH. If a class has just 20 kids in it, that’s $375, 000 / class. And remember, if the State is going to pay THAT much money, you can be sure that there will be “strings attached”. I’m already longwinded here but it will come down that there will be no local control over budgets, activities, and curriculum over some amount of time. After all, every time that money and Power centralizes, we end up with that Central Power no longer trusting the locals “to do the right thing” with our their money.

And here’s where it gets really good – and really personal:

So let me put some economic reality around that for everyone.

We currently spend $23,172/student to educate a public school student in our town [1139 expected students in `19, and a just approved school budget – before warrant costs – of $26.393 million]. Our tax rate for `19 for school funding is expected to be just about $10.96 (which is made up of $8.82 town school tax + $2.14 state school tax). So, if this went through our state tax would go up to ~ $14.50. For that, our rebate would be $15,865/student. BUT, we are contractually committed to paying the school $23,172 per student. As such, we’d need to raise at the town level an additional $3.46/$1000 home value to make up for the $7,307/student we’d be short versus contractual spend commitment after getting our state rebate. So, our total school tax would go from $10.96/$1000 house value to $17.96/$1000 house value – a 68% tax increase.

Betcha Andru Volinsky ain’t talking about that tax increase – and the analysis is REALLY going to give you a real punch in your financial gut:

Now, let me extend the economic reality to home values.

Home values are determined by the monthly mortgage payment that the area can support through wages & salaries. [The same is true for car values, that’s why car companies try to keep raising the vehicle price, but have to extend the average term of the loan to 5+ years so that the monthly payment is affordable to their target audience]. Read that again.

Let’s assume that over any short to medium term period of time, the earnings power of a town doesn’t change much. In other words, the ability to earn the principal, interest and taxes necessary to meet the monthly mortgage payment is fairly fixed. If that’s the case (which it is), then a 68% rise in taxes would destroy about 10% of the value of an average home instantaneously in our town (assuming a $300k average home value, and a mortgage on 80% of that value).

Here’s how the math works:

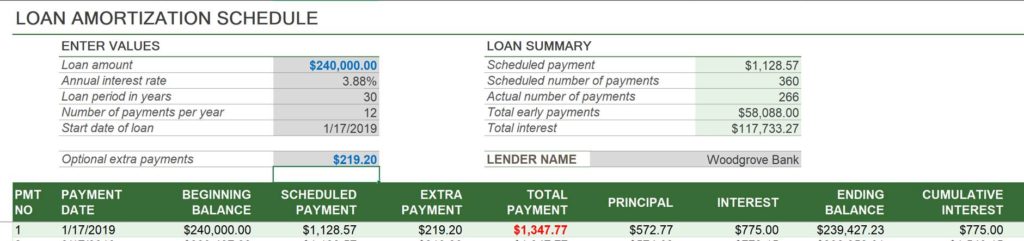

Here’s the monthly PIT payment for a $300k value home with a $240k mortgage (20% down payment) This assumes our current tax rate for school funding. The red numbers are the monthly PIT payment, which we assume is fixed. The blue numbers are the mortgage value and school tax rate per month based on the mil rate for total school tax

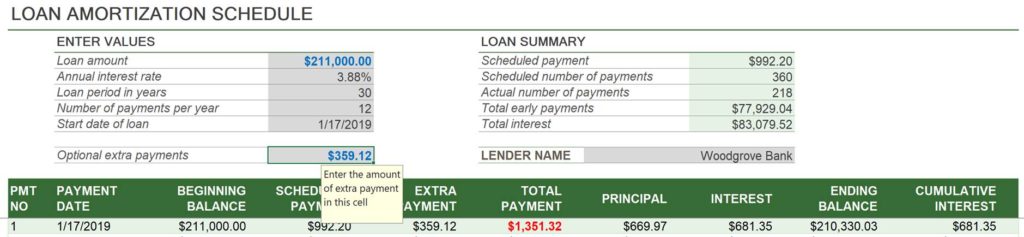

Now, let’s assume their plan goes through and we have a 68% school tax increase. Below is the value of the house if we instantaneously increase the school tax based on the campaign objective of equal funding for all taxpayers across the state. All I’ve done is plug the new tax rate (monthly dollar value) into the calculator and solved for the new mortgage value (house value minus down payment) that would keep the monthly payment the same. To keep the PIT stable, the house mortgage value would have to decrease from $240k > $211K, about a 10% reduction in home value ($30k reduction on a $300k home financed at 20% down payment). So, someone that had put down $60k in a down payment would instantaneously lose 50% of their equity (down payment) in the home (assuming someone bought the house in the last few years).

Needless to say, we can not let this pass.

I don’t have the financial wherewithal to do what this analysis does but let me add the politics that surround it.

This is simple Saul Alinsky tactics of the Have Nots and the Haves. In this case, Andru Volinsky is trying to work the system under “fairness” to punish the Haves’ to reward the Have Nots. It doesn’t take into effect ANYTHING else that goes into education – and never EVERY mentions differing rates of actual student achievement.

Which, to most of us, is the actual goal. Nothing said about child motivation, nothing said about curriculum, nothing said about sticking to basics, and nothing about parental choice or involvement. Money sags when compared to these other factors but that ruins Volinsky’s spiel and determination to affect economic redistribution under the rubric of “it’s for the children“. Trust me, while it may appear to be that, the reality is far from it. And trust me, he will use Alinsky’s Rules for Radicals against anyone that tries to stop him.

And being a Progressive, his intent IS to further centralize what used to be local control up the ladder to the State to where your opinion and your input will count for less and less. Your town will lose more of its ability to govern itself. As a Progressive, he DOESN’T trust you to do the right things and it is VERY obvious that he doesn’t believe you should be in charge of your own money. He wants Government in charge and in charge HARD and up the chain such that you will have no say in it at all.

Is that what you want?

Unless, of course, you want him to take down your home value – and even a lot of poorer people own homes.

At least right now.

Needless to say, we can not let this pass.

(H/T: Instapundit)