The recent—and unfortunately more regular—flooding Vermont has experienced since last summer has damaged a lot of infrastructure, but the impact on our roads due to washouts is a big one—and an expensive one for the state and local municipalities. This raises a critical question of where the money is going to come from to fix all this, as we are learning that we can’t really count on FEMA!

The way we currently fill our state Transportation Fund to pay for road maintenance is the state tax on gasoline and diesel. As far as taxes go, it’s a fair one: you use the roads, you pay a tax directly related to how much you drive. If you drive a lot and buy a lot of gas, you pay more; if you drive seldom and buy little gas, you pay less. But currently, if you drive an electric vehicle in Vermont, you pay nothing. And that is not fair.

To its credit, the legislature passed a law this year that will change EVs’ free rider status starting in January 2025. At that time, the DMV will begin collecting an electric vehicle surcharge of $89 for one year or $163 for two years ($44.50/$89 for hybrids) when the car is re/registered. Good!

But, bad…. The revenue collected will not go to road maintenance. (Frown emoji.)

Instead, the money will be diverted to pay for “non-public EV chargers that are hard to fund with existing federal and state programs (Governing.com).” (Mystified emoji.) So, EV drivers will still be getting off scot-free when it comes to shouldering their fair share of keeping our roads and bridges passable and safe for everybody. Still unfair. Especially when we have emergency situations in so many communities where that revenue is and will be desperately needed.

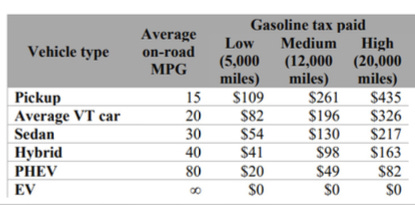

Also bad…. The $89/year fee, while a commendable start, is still less than half of what the average Vermont driver of an average-sized internal combustion engine (ICE) vehicle pays in gasoline taxes over the same time period, which is around $196/year according to a May 2024 VT Agency of Transportation report. This is despite the fact that EVs, because they tend to be significantly heavier, cause more road wear and tear than their ICE counterparts of similar size. That’s not fair, either.

So, here’s a suggestion for the newly elected legislature when it returns to Montpelier in January 2025: The first order of business is to change the law so that the EV fees go to road maintenance just like gas and diesel taxes, and increase the fees so that what EV drivers are contributing better reflects their fair share of the costs of using our roads. And, if you do really want to keep the EV fees in a separate pot from the gas and diesel tax, how about earmarking them for an emergency maintenance fund to provide aid to municipalities in cases of natural disaster.

This is not a flood-fixing panacea by any means. The estimates are that these EV fees will raise $912,000 in fiscal year 2025 and $1.7 million in FY 2026 (JFO). To put that — or even doubling that — into perspective, in a recent article about the flood damage in Moretown, an engineering consultant was quoted when pointing out, “This culvert here is going to be $1.5 million. Just this culvert (Times Argus).” The state’s overall 2024 transportation budget is around $860 million. So, it’s a little bit, but a little bit where every little bit helps.

The main point is that we need our state government to get back to raising the resources we need to maintain our critical programs in a fair way, and we need them to invest those resources with a more practical sense of priorities.