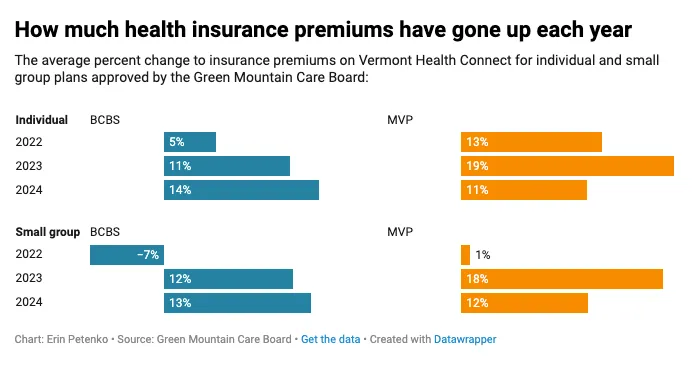

Ask people why Vermont is unaffordable, and health insurance is one of the main pillars of our unaffordability crisis, along with education property taxes, the cost of housing, and energy prices. These highly regulated by our legislature plans go up every year by amounts far in excess of inflation. For 2024 alone, the Green Mountain Care Board approved individual rate increases for Blue Cross and MVP of 14 percent and 11 percent, respectively. That was over $1000 a year on top of already high premium costs.

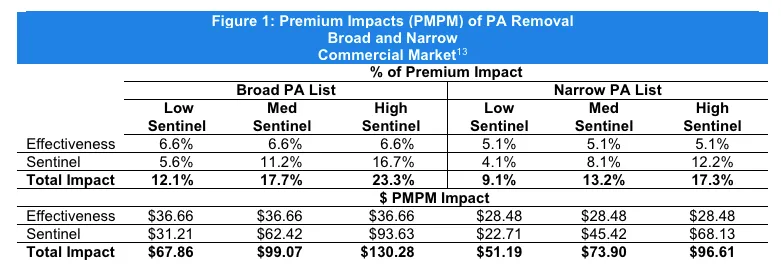

So, this year, our crack squad of Supermajority legislators dove right in to figure out a way to lower the future costs of Vermonters’ health insurance, right? You would be wrong! 180 degrees wrong! Far from working to lower costs, the Supermajority rammed through H.766, An act relating to prior authorization and step therapy requirements, health insurance claims, and provider contracts. And this bill, should it become law as it looks likely, is estimated to tack another 3-7 percent cost increase ON TOP OF those already unaffordable double-digit increases.

How does the bill do this? It eliminates insurance companies’ ability to require “prior authorization” for certain healthcare services. Prior Authorization is the process of discovering if a service is actually covered by the policy, is the ‘best practice’ for the patient, and if there is a more cost-effective solution to achieve the same outcome. The benefit of the H.776 is that it would eliminate paperwork — the cost and time that is required – at the doctor’s office. While that is certainly a good thing, it comes at a significant cost to policyholders. The question is, is it worth it?

As MVP warned,

If the bill is enacted as is, Vermonters will pay significantly more for their health care, coverage options will continue to erode, and access issues will worsen. To our knowledge, no other state has taken such extreme positions on these issues. Our concerns are not hyperbole, and we cannot emphasize them enough on our roughly 27,000 Vermont members’ behalf.

Cigna chimed in,

There is no scenario where this costs less or some di minimis amount. Vermont families and small business are struggling to afford the high cost of health care, and H.766 will only compound these problems.

But, hey, these are greedy insurance companies, right? What do you expect them to say? Fair enough. So, how about we get a neutral opinion on the likely cost of this bill before we pass it into law? Sounds reasonable. NOT INTERESTED! Says the Supermajority.

This…

PLUS, this… is what the Supermajority is doing to Vermonters’ health insurance costs.

The Vermont Department of Financial Regulation warned in written testimony,

Estimates ranged from a 3-7% increase for members premiums based on the version of the bill as passed by the House (on top of any other necessary rate increases). These projections led us to recommend that an actuarial study be completed to better understand the cost impacts of the bill prior to enacting these consequential changes.

“Don’t care!” says Supermajority. There will be no actuarial study. The DFR letter goes on…

We remain concerned that to the extent that provider burden is ameliorated by this bill, it will be outweighed by potentially significant premium increases that will contribute to the diminishment of regulated health plans as employers and individuals seek lower-cost health coverage. DFR recognizes the importance of reducing provider administrative burden, but we also recognize the importance of cost control measures so that health insurance remains affordable. We believe that commissioning an actuarial study to evaluate the cost impact of Sections 2 and 3 of H. 766, prior to enactment or effectiveness, is a necessary and prudent step to evaluate the potential costs and benefits of the bill.

At this point our elected representatives have their fingers in their ears, eyes jammed shut, while repeating over and over again, “Lalalalalallala!” Necessary, prudent, and evaluate are not in their vocabulary let alone their governing philosophy.

Just so you know, a similar report done in 2023 for Massachusetts, which outlined the potential impact of eliminating prior authorization, concluded that commercial premiums could increase by between $600 and $1,500 per member per year, and Medicaid capitation rates could increase by between $270 and $1,100 per beneficiary annually if prior authorization were eliminated. So, maybe this is something Vermont lawmakers should take seriously.

Nope! In another blow to small businesses trying to provide benefits to their employees and individuals trying to make ends meet, the roll call vote in the House was 104-23 in favor of driving up your health insurance premiums. Senators didn’t bother to go on the record. It’s not their money after all.