It’s simple. Supply vs Demand, with the Government artificially manipulating the marketplace because it controls the third leg of the housing marketplace – interest rates.

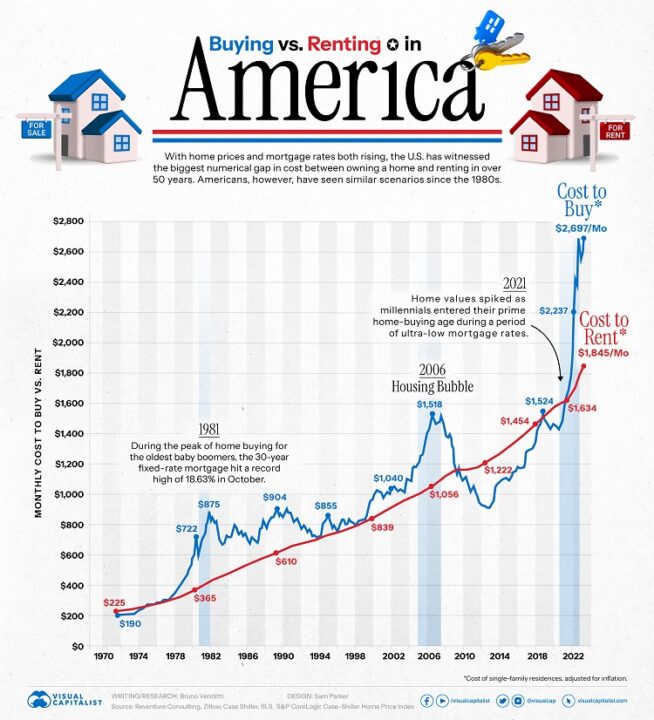

The Monthly Cost of Buying vs. Renting a House in America

With home prices and mortgage rates both rising, the U.S., has witnessed the biggest numerical gap in cost between owning a home and renting in over 50 years. Americans, however, have seen similar scenarios sine the 1980s.

Look at that note for 1981 – I was just starting my career at that time with Honeywell Information Systems/Wang Labs, and I had friends that were buying their first homes at that time. I also had friends who had owned their homes for a few years at that time. The latter were exulting in how much in valuation their homes were gaining and the low-interest rates under which they had bought their homes. The former were gritting their teeth and willing to take that HIGH risk (some had 16, 17% rates) just to get out of their apartments or had moved from other parts of the country and HAD to get a home for their families betting that the bank rates would go down and they could refinance.

Me? We bought a starter home at a decent price after that spike, and we sold that house in MA just after the top of that price spike and bought our current “starter” home here in NH (to which we never “upgraded,” mostly because of our “inertia”) as the market was still rising (I was offered more than $30,000 for it two weeks after we moved in by some random driver who stopped and asked).

We rode out the 2006 bubble as we watched our valuation go up and then sink (just not below what we had paid for it).

While the CRA was later faulted for being the driver behind it (forcing banks to lend to people, often without income verification, who couldn’t afford the monthlies and lost those homes), this time, it is simply the rates. Supply is down because of land use restrictions, to a point, but also increased rates. Both have lessened the supply of available houses, but the latter is more influential, IMHO, than the former.

After all, my home has gone up over $200,000 in two years (a STARTER home!); I would have a good cushion to use towards a larger home IF I wanted. But WHY would I want to double (if not more) my mortgage rate in doing so? Spend more for larger, yes; spending more artificially for not much larger? That would be silly, right? Why give up a 3-percenter for a 7 or 8-percenter. That math don’t hunt for me.

This bubble? Not only are the Fed rates killing the housing markets, but we’ve already seen what they have done to some large banks by rendering their holding worthless (holding notes too low in comparison to the current rates).

(H/T: Visual Capitalist)