I started on this kick back in the late 1990s as I became more politically aware and conscious of how politicians were always on the hunt for my wallet – and there’s nothing wrong with my sense of self-interest in protecting that private property.

My voice got louder once elected to my hamlet’s budget committee when the Town and School Board kept saying, “But it’s Free Money.” All kinds of grants that I asked about and later found were an on-ramp for the Town and School District to spend OUR money – “They’ll pay for one cop and two firemen now, but we must keep them on the payroll and pay all of it after the initial three years.”

It’s the same story with our “sidewalk to nowhere,” for which a six-grade class’s students got a grant. Nothing ever financially ratchets downward – NOTHING.

And thus, we get into this situation:

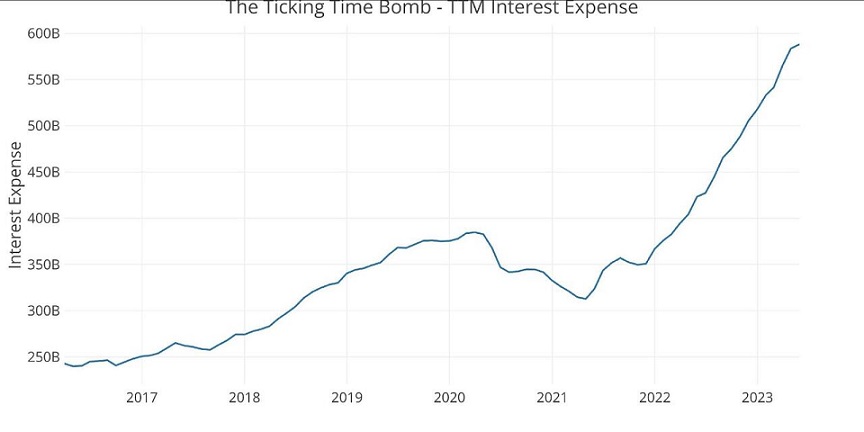

The problem isn’t purely a function of more debt. The bigger issue is that this new debt comes with a much steeper price tag. Interest on the national debt is rising at an alarming clip. The trailing 12-month (TTM) interest on the debt clocked in at just under $600 billion in May. This was up from $350 billion at the start of 2022, less than 18 months ago. The government has added an extra $250 billion in expenses per year on just debt service.

This is just the beginning of an upward trend. Based on the current interest payments, the Treasury is paying less than 2% interest on the total debt. But a lot of the debt currently on the books was financed at very low rates before the Federal Reserve started its hiking cycle. Every month, some of that super-low-yielding paper matures and has to be replaced by bills, notes and bonds yielding much higher rates. That means interest payments will quickly climb much higher unless rates fall.

Looking at the Treasury sale on June 26 reveals the extent of the problem. The Treasury sold $162 billion in securities, with $120 billion in short-term Treasury bills with high yields.

- $58 billion in six-month bills at an investment yield of 5.45%

- $62 billion in three-month bills at an investment yield of 5.34%.

- $42 billion in two-year notes at a high yield of 4.67%, amid very strong demand. Longer-term yields are still far below short-term yields.

For comparison, the entire US military budget is $858 billion. If interest rates continue to rise, that National Debt Interest is going to soar and can very easily take over most of the Federal budget quickly (go ahead, do the compute exercise if rates go up 3% or 4% over the next few months.

The question then becomes, WHO is going to take the haircut financially? And when that happens, WHO and HOW will be blame apportioned and met out? I would like #HeadsOnPikes for any politician that voted for the policies that led us up to this point. Starting with our own Federal Democrat coven of financial witches…but I’m not averse to going back in time for others (regardless of party affiliation) to do the required “wash, rinse, repeat”.

Will we, the electorate, finally figure out that it is our elected representatives that need to have their political heads (e.g., removal from Congress and the White House) removed?

(H/T: ZeroHedge)

Politicians claim their bills bring us good things. Free health care! Child care! A cellphone for all!

But government isn’t Santa Claus. Government is force.

Most every law takes away a little of our money or freedom or both.