Dylan Mulvaney may have been excited to share the news about the deal with Bid Light, but the brand has had a little hiccup. Anheuser Bush Market Cap has declined about 3%, which doesn’t sound like much until you realize that equals 4 billion dollars.

On March 31, Anheuser Busch had a $132.38 billion market cap

As of today, it’s now $128.4 billion

You know what that means?

The Woke Bud Light campaign has already shaved off nearly **$4 BILLION** in company value

Don’t let Dems lie to you – Conservative Boycotts WORK pic.twitter.com/xLGbs6F1MV

— DC_Draino (@DC_Draino) April 10, 2023

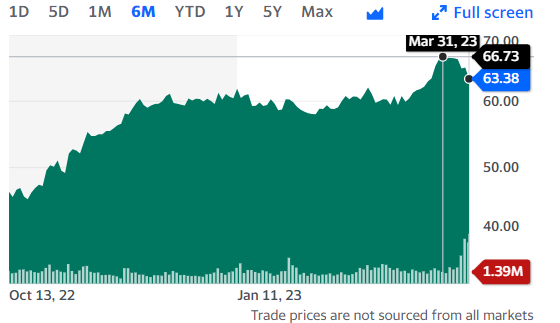

Now 4 billion is next to nothing for a company that size, and no one is ringing alarm bells or battening hatches. But the stock price had been on a six-month rise, up over 40%.

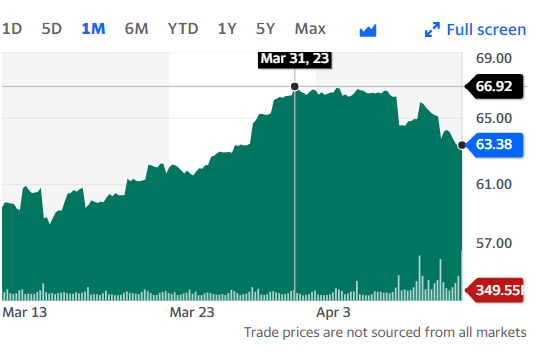

Since the end of March, BUD has declined a wee bit.

It might all be a coincidence. In Dec of 2016, BUD peaked at 131.40 per share. I didn’t check to see if they did a stock split, but it hasn’t gotten anywhere near there since, but before the beginning of April, it had been rising for six months straight.

In other words, much like the climate, there are many moving pieces. It’s much too early to tell if BUD will “go broke after going woke.” And by broke, we mean paying a meaningful price for the virtue signal like Gillette. They lost 8 billion before someone at P&G picked up the phone and said, no mas!

As for BUD, one Twitter reply said they’d need to lose 100 billion in Market Cap before anyone blinked, but that’s ridiculous. No one bats an eye until you’ve lost 75% of its value; what businesses did you run?

I guess the question is this, and I will leave it to you to debate. How black of an eye is required before, if ever, the #wokefolks at Anheuser Busch discover that the people who pay for the fuel in their private jets one twelve-pack at a time are not as interested in the transgender agenda?