When a nation’s citizens and its leaders decide that money is no object, money will have no value. For YEARS, while on my town’s Budget Committee, that which cannot be sustained, won’t. Stop taking the “free money” and start being self-sufficient – priorities will sharpen and the “strings attached syndrome” will go away (in which “free” becomes “we will pay MORE over the years for taking the free money than what the free money was worth”. At some point, as the passed British Prime Minister Margaret Thatcher said so pithily (and correctly):

At some point, you run out of other people’s money.

Has the US just done this? Are we FINALLY into Weimer Republic territory (and if your Government School education failed you as to what that was, email me)? Has the Progressives’ infatuation with Modern Monetary Theory now leading us to a national default (and once again proving Thatcher right and showing we SHOULD have looked to history to learn “what not to do” in just more than Germany? Emphasis mine, reformatted:

Fed Will Soon Return to Money Printing to Avert Government Default, Says Analyst

For all the talk about combating inflation, the Federal Reserve is likely to reverse course and continue to print substantial amounts of money because doing otherwise would threaten the federal government with insolvency, according to macroeconomic analyst Luke Gromen….

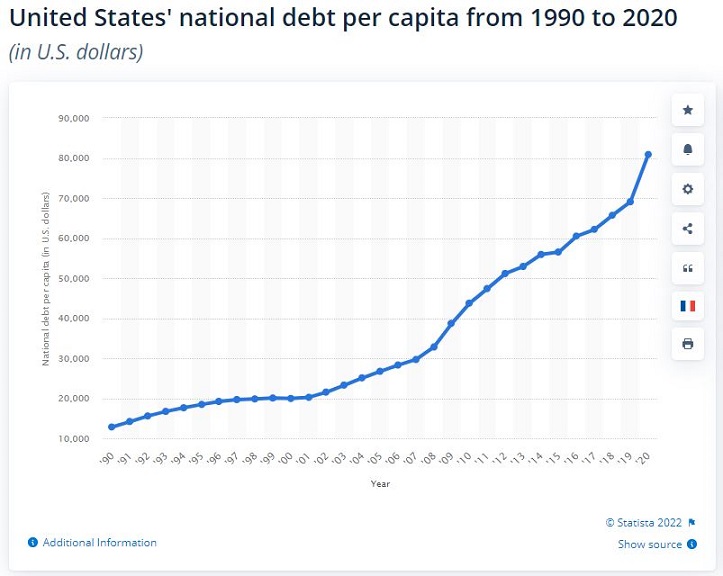

…The problem is that higher interest rates mean that government will have to pay more interest on its debt, which now stands at over $30 trillion. Moreover, higher rates mean less credit and less economic activity. What is already becoming apparent is that higher mortgage rates mean fewer home sales and less construction. That means the government will start collecting substantially less in taxes, according to Gromen. Meanwhile, a contracting economy translates to higher welfare expenses as more people go to the government for relief.

“The U.S government is not going to be able to cover its interest and interest-like expenses, which I call the true interest expenses—entitlement, pay-gos, Treasury spending—they’re not going to be able to cover that with tax receipts, which means they will have to default or the Fed prints the difference,” Gromen said.

He believes the Fed won’t allow a government default. “At the end of the day, if push comes to shove, they’re going to print the money,” he said…Printing more money, however, will make inflation worse and the problem can quickly snowball, especially if the government decides to appease the public with more giveaways, such as some form of “Universal Basic Income.”

“Won’t allow a government default” should have said “forestalls a government default”. Given that we are $30 Trillion in debt, our feckless elected “leaders” have effectively spent us into a financial death spiral because THEY couldn’t control our spending by correctly setting priorities and assuming some kind of strong financial discipline. Instead, they look at money as just a string of zeros to the left of the decimal point and assumed that there is no meaning to the word “scarcity” – that you can’t have it all and you certainly can’t GIVE everyone everything.

The rooster is starting to crow and the cows are starting to come home – and we’re the ones that will end up being the broken eggs.

We’ve gone from being a hard-working nation that knew the value of a dollar to an indolent, lazy, lay-about citizenry that has too many people in the wagon instead of pulling the wagon. The entrenched DC (and Concord!) politicians won’t ratchet down the spending until that financial unmovable brick wall hits them (and us) right in the gut as then there will be no dollars left.

How will you face your grandchildren and great-grandchildren?

(H/T: Epoch Times)