He complains that the State is requiring $4+ million in “new” pension plan payments. What, he hasn’t known what’s going on? Did he take his eyes off the Bigger Pictures?

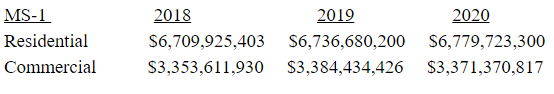

All of Nashua’s problems are not caused by the state; the pandemic and the decisions of our local elected government contribute to our challenges. How have our assessment valuations changed from October 2018 to October 2020?

The loss in commercial valuations could be the result of vacancies and pandemic income losses. However, there will be additional commercial losses in 2021-2022 as a result of abatement applications and appeals submitted due to the pandemic.

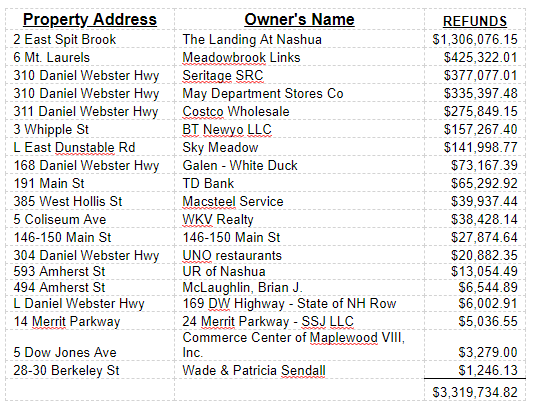

Maybe this is why the assessing department is in no hurry to complete residential abatement applications. It should be about equalizing property assessment; but, more likely, it’s about saving money.

Listed below are some of the abatements that have been given out in 2020 and 2021 for commercial properties. These abatements total $3,319,734.82 and do not include interest that must be paid to the property owner.

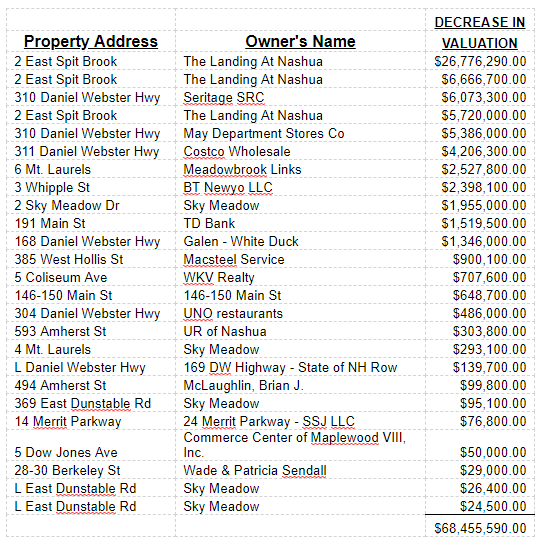

As of May 2021, the valuation on commercial properties have gone down by $68,455,590 at minimum. Listed below is the actual decrease in valuation that residents know so far:

Bottom line: it’s not all the state’s fault and we have been receiving quite a bit of COVID money. The State’s mandate for pension funding is hurting Nashua taxpayers; however, in relation to the schools, if the children are not going to public schools, the State does not have to pay. Period. That is not the State’s fault.

What one must realize is that the City of Nashua needs X number of dollars to run the city. If the valuation on commercials is going down, then the tax rate is going up in order to get the money the city needs in order to run the city. Residents may not like it but those of the facts.

Get set for another increase in the tax rate for the City of Nashua.