Massachusetts is imposing Massachusetts income taxes on New Hampshire residents when they neither reside nor “work” in Massachusetts. It seems intuitively obvious Massachusetts is overreaching. But Massachusetts downplays the seriousness of New Hampshire’s claim in three ways.

Related: NH Lawsuit: I Think Taxxachusetts Has Screwed Itself Again

First, Massachusetts contends that the Massachusetts Tax Rule does not impede any tax policy New Hampshire desires to implement. It is unsurprising Massachusetts fails to appreciate New Hampshire’s rejection of broad-based taxation. Massachusetts takes a fundamentally different fiscal approach.

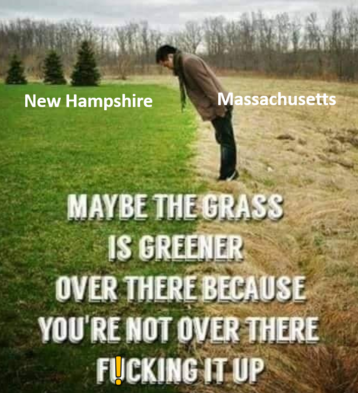

This rejection is central to New Hampshire’s sovereign identity. But New Hampshire’s sovereign interests are no less serious because Massachusetts thinks its own policies are preferable. Within their own borders, for their own citizens, Massachusetts has every right to make and enforce its tax law. That ceases to be true at the New Hampshire border.

Second, Massachusetts contends that the Massachusetts Tax Rule merely maintains the status quo. Its position is Massachusetts continues to impose an income tax on non-residents solely for Massachusetts sourced income. This assertion is false.

In fact, Massachusetts has radically redefined what constitutes Massachusetts sourced income. It did so in order to tax earnings for work performed entirely outside its borders. This does not maintain the status quo. It upends it.

Third, Massachusetts insists that the Massachusetts Tax Rule addresses a temporary problem. Yet even in the short time New Hampshire’s motion has been pending, Massachusetts has extended the Tax Rule indefinitely. A rule in place, with no end specified at any date certain, is de facto, permanent.

There are numerous friend of the court briefs from other parties. They clearly demonstrate this is an issue of national importance. It is certain to survive the current pandemic. SCOTUS should grant New Hampshire’s motion for “Leave to File a Bill of Complaint.”

Wrapping it all up

Massachusetts realized its employers were having their people work from home in New Hampshire. They decided they had the right to collect taxes across the border in New Hampshire. A remote schoolyard bully demanding Granite Stater’s hand over their “lunch money.”

What’s the difference between what Massachusetts is doing and allowing Delaware to collect income taxes from all of the employees, of all of the companies ‘domiciled’ in Delaware (and there are a lot of them), but operating in all the other 49 states? Big, big rats nest.

Will the US Supreme Court will clear it out or make it worse?