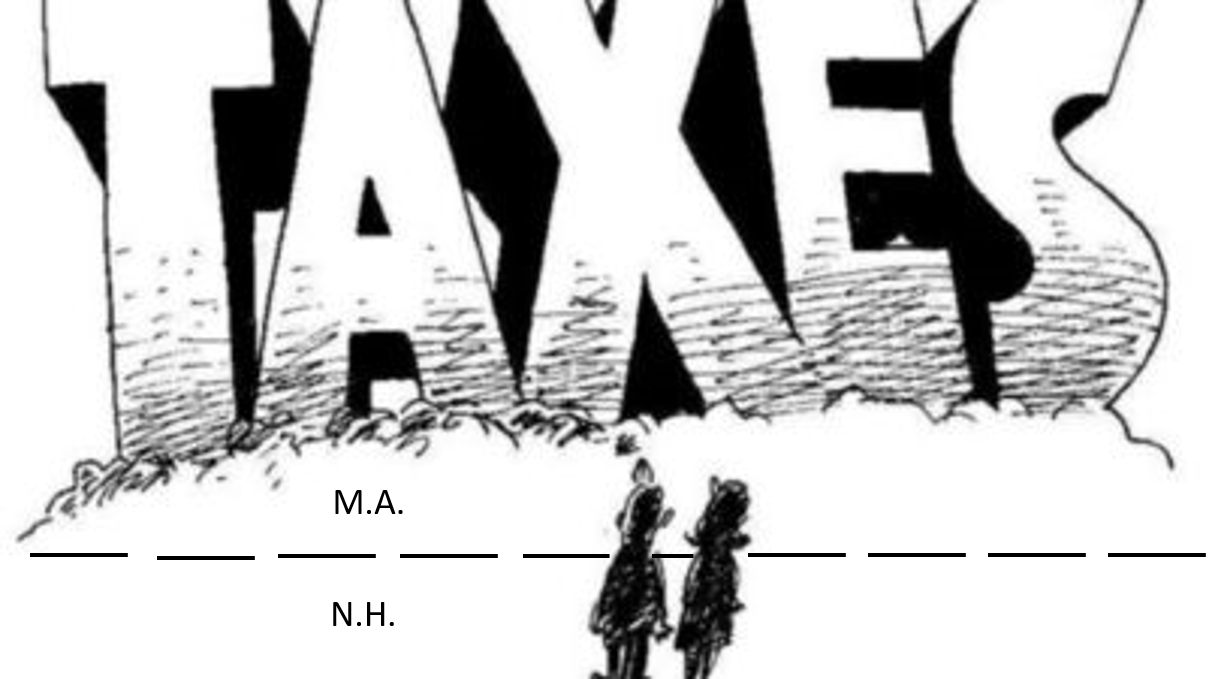

New Hampshire has a lawsuit against Massachusetts. The Bay State tweaked its non-resident tax rules when the Rona hit. Anyone forced to work remotely who never had or was forced to work remotely more often would still pay Mass. taxes on those remote wages.

Related: Another Massachusetts Cross-Border tax scam?

Both sides of the aisle in the Granite State were miffed. To borrow from Muppet Greta, “How Dare You.”

The combined noise resulted in a lawsuit claiming this was unfair. Massachusetts, which repeatedly cut its own fiscal wrists long before the Rona landed, is just doing what one-party states (even with a RINO figurehead) do. Scrabble for every dime to stop the unstoppable budget bleeding.

Massachusetts wants it pounds of flesh, and New Hampshire insists it’s not legal or just.

In response, the Lowell Sun published an Editorial that said, if you don’t want to pay Mass taxes, don’t work in Massachusetts.

Massachusetts Attorney General Maura Healy issued a 48-page brief to the US Supreme Court explaining why they should ignore New Hampshire’s suit and toss it to the curb like a Bay State hourly Restaurant Employee or, better yet, their employer.

She makes a few points I’ve posited for why NH’s challenge may be doomed to fail.

You can file an appeal with the state of Massachusetts if you feel you have been mistreated. But that’s like saying you need to interface with the DMV before every turn signal. A bad analogy because Massachusetts drivers don’t use them. If they did would they want to embrace the suck of the bureaucracy or pay up, and is that why they don’t use them?

Healy also notes other rule expirations and thresholds that apply, and hey, other state’s do it too! That doesn’t make it right or wrong, but then I read this (and smiled).

The Commonwealth previously allowed out-of-state residents who worked for Massachusetts-based entities to deduct whatever portion of their income was derived while working from home. That meant an out-of-state worker who commuted, say, four days a week but worked from home one day a week could reduce their taxable income by 20-percent.

This spring, the state revised the policy to cap deductions at the proportion of time spent working remotely before the pandemic, meaning if an employee is now working from home five days a week instead of just a single day per week, they can still only deduct 20-percent of their income.

Do you see the problem that I see?

None of the people you are taxing chose to be remote workers. The State of Massachusetts forced them to stay home (and work if they could). If they could not work, those covid-lockdown lottery ‘winners’ paid no Mass taxes because they had no income. If you could work remotely, you did because that was the only way to continue getting a paycheck, which Massachusetts is taxing as if you were not remote.

Like most Dem run cesspools, they are not very clever down there.

The normal rule allows remote workers to reduce their Mass tax for days they normally work remotely. Massachusetts forced them to work remotely. Why not just continue to do things that way? When the rule rolls back in January, make that your 2021 new normal.

Thousands, perhaps tens of thousands of New Hampshire workers, may never need to step foot in Massachusetts for work again. They can telecommute as often as possible and save a lot of money. No Massachusetts taxes, motor fuel, vehicle maintenance, tolls, parking, all of which they will pocket and spend in New Hampshire.

Many local businesses will benefit in New Hampshire, while across our southern border, the businesses they once frequented will wither.

Maybe those businesses can relocate to New Hampshire, taking more business and payroll tax revenue away from Massachusetts.

The Lowell Sun is correct. If you don’t want to pay Mass Taxes, work in New Hampshire or from New Hampshire. Of course, that will result in a new Massachusetts rule that will attempt to tax all remote workers (gotta have those tax dollars), which would be something the Supreme Court would probably want to review.

We can do it now or later. Either way, I think Massachusetts has screwed itself again.