The new administration is broadly rolling back almost all Trump-era regulations. Of local interest is a regulation meant to protect businesses from political targeting. Businesses like gun manufacturers and cryptocurrency exchanges had protection from denial of banking services. No more.

The Office of the Comptroller of the Currency (OCC) released a statement. In it, the department says the new move allows the comptroller to review the rule and public comments the office had received. OCC suggests banks not terminate broad categories of customers without assessing individual risk.

The Fair Access Rule Came in the last weeks of the Trump administration. It was set to go into effect April 1. It states “banks should conduct risk assessment of individual customers, rather than make broad-based decisions affecting whole categories or classes of customers when provisioning access to services, capital, and credit.”

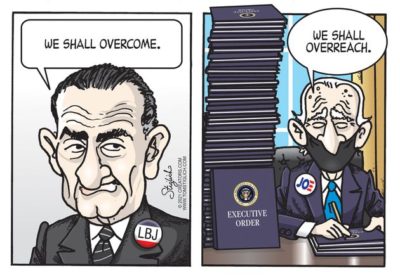

The road to hell

The intention of the regulation is to shield legal, politically unpopular companies from banking discrimination. It was a response to Obama era Operation Chokepoint. Chokepoint was from the Justice Department. The talking point asserts the program design was to combat fraud. That is not its practical effect.

In practice it empowers the government to target industries it does not like. This included at the time payday lending and pornography. It works by “coercing private businesses in an attempt to centrally engineer the American marketplace based on its own politically biased moral judgments.”

Former U.S. Attorney Frank Keating wrote for The Hill. “Officials at both the Comptroller of the Currency (OCC) and the Federal Deposit Insurance Corporation (FDIC) threatened banks with regulatory pressure if they did not bend to their will… Gun and ammunition dealers, payday lenders and other businesses operating legally suddenly found banks terminating their accounts with little explanation aside from ‘regulatory pressure.”

In 2017 Trump’s Department of Justice put an end to the program calling it “misguided.” Their statement said:

“law-abiding businesses should not be targeted simply for operating in an industry that a particular administration might disfavor.”

Trying to help

Trump’s banking’s Fair Access Rule went a step further. It prohibits financial institutions from discriminating against entire industries. Andrea O’Sullivan at the James Madison Institute argues: Trump’s rule would’ve protected unfairly targeted businesses. Ms. Sullivan wrote:

“The largest banks in the country—those with more than $100 billion in assets—would be prohibited from red-lining politically disfavored industries just as they are prohibited from red-lining politically oppressed populations… Rather, a gun manufacturer or pornography company or payday lender must be evaluated on the terms of their individual creditworthiness.”

Not everyone agrees with this assessment. John Berlau is a senior fellow at the Competitive Enterprise Institute (CEI). He says the banking’s Fair Access Rule has broad wording. It would do more. Not only does it prevent large banks from discriminating against unpopular businesses. It would also force small banks into relationships with businesses they do not have the background and expertise to handle.

Berlau asserts, “Under this rule… a digital bank could not say, ‘We’re not lending to paper companies [a company without operations that exists exclusively for a financial reason] because it’s not our business model.'”

Intentions and actualities

There are reports the regulation would only affect banks with $100 billion in assets or more. That is not actually what the rule says. A small bank would be covered by the rule when it charges a higher cost for a loan because a customer is in an industry the bank does not typically handle.

So, a smaller bank could also feel the be affects. It would happen if it refuses a loan to that customer… And that rejection causes a competing bank to raise its price for a loan to that same customer. Berlau says:

“Vague terms like that can almost always be stretched to apply to just about any market participant,”

Berlau cites the Bird-In-Hand Bank of Pennsylvania as an example. It is a small rural bank specializing in providing loans to the Amish community. Berlau says:

“If, for whatever reason, it didn’t serve a new line of business or decided to charge more interest… it could have conceivably raised the price [of a loan] because it offered an option where there are limited options.”

The new administration is moving aggressively consolidating political power

Berlau argues, preventing banks from discriminating against certain industries violates their right to free association. This would hurt niche banks specializing in specific industries. Such banks exist in farming, industrial lending, or financial technology. The rule forces them to lend to businesses with which they are less familiar. That is riskier because of their lower level of expertise in unfamiliar industries.

A spokesperson for the OCC says the next comptroller will review the Fair Access Rule. The purpose of the review is to determine its future. Biden has made no nomination for a comptroller. So the office could not provide a timeline of when a decision may happen. It is apparent this decision is purely political. It is a move in consolidating political power.