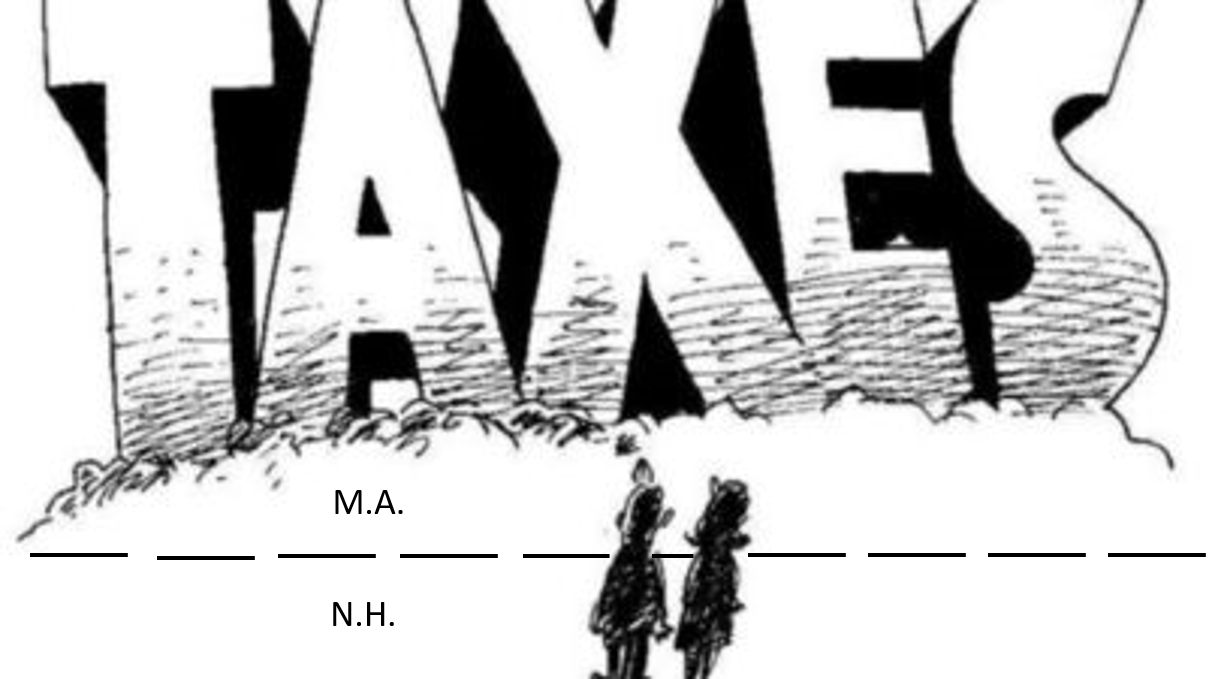

In the latest act of the ongoing saga “Massachusetts taxing remote workers in New Hampshire,” the Lowell Sun has a suggestion. Stop whining.

Related: NH Dem Timothy Horrigan Tells Massachusetts They Should Tax Remote NH Workers

If Granite Staters want the full New Hampshire tax advantage, get a job in your home state.

The commonwealth shouldn’t be expected to waive needed revenue from out-of-staters employed by Massachusetts companies.

Sorry, New Hampshire, this is one tax advantage you haven’t earned.

In other words, you’re getting taxed bitches, get over it.

The article does make a reasonable argument in the Bay State’s favor. It is not uncommon. If the Supreme Court were to deny MA the right to tax employees working outside its borders (employed by businesses in-state), that would apply nationwide. It would also, and I’m speculating here, put a monkey wrench in their recent decision to allow cross-border sales tax. Maybe.

Lawyers in robes are still lawyers. I can’t say they’ll find for NH, but Id like that.

The other issue, of course, is that regardless of where your “corporate office” is, remote workers pay taxes where they do the work. And a lot of remote workers do this all over the nation.

The other stop whining claim is that the requirement is due to expire on Dec. 31 or 90 days after the coronavirus state of emergency in Massachusetts ends. Which is never by the sound of things, but even if it were not, the one thing that will never expire is Massachusetts spending.

So, what the Lowell Sun is probably saying is, if you don’t want to pay MA taxes, get a job in New Hampshire, but please don’t. They need the revenue.