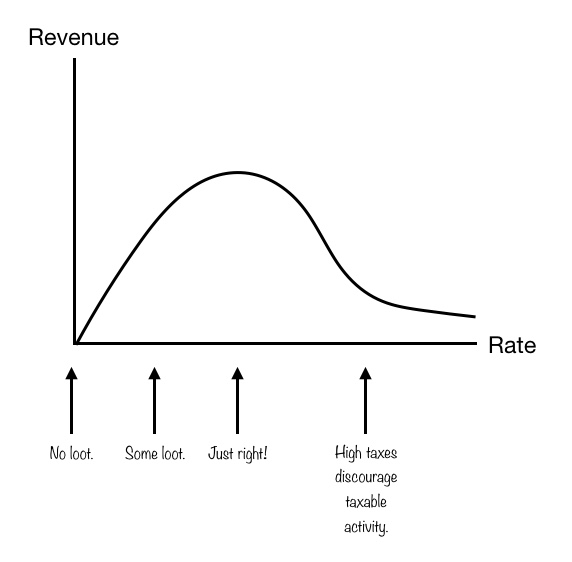

How does a tax rate get set? For example, what makes the top federal income tax rate 37 percent, instead of 70 percent (as it was when I graduated high school), or 91 percent (as it was when I was born), or any other percentage? The basic idea is that the government wants to set a rate that maximizes revenues.

That’s the practical consideration. But note how neatly it glides past theoretical and moral considerations that are never discussed. In particular, once the government has the authority to confiscate 1% of your income (or assets), what keeps it from having the authority to confiscate 100% of the same?

Spoiler alert: Nothing.

Sometimes, just changing how we describe something helps us change how we think about it. One way of doing that is to change what we focus on.

For example, we often focus on the fact that the percentage of students who reach proficiency in English and math is higher in New Hampshire than in most other states. This encourages us to think of ourselves as being among the best states for education, and that leads to one kind of conversation.

But we might focus instead on the fact that only 40% of students are reaching proficiency here. Or, switching from figure to ground, we might focus on the fact that 60% are not. This would encourage us to think of ourselves as being among the least worst states for education, and that would lead to a very different kind of conversation — one that we desperately need to have.

In a similar way, we might change how we think about income taxes (including business taxes) if we change our focus from what we pay to what we keep.

When you work on commission, you bring in revenue for your employer, and he lets you keep some of it. For example, if you sell something worth $5000, and he makes a profit of $1000, perhaps he lets you keep $200. It’s his money, but he’s letting you have some of it as an incentive to get you to bring in more. How much does he give you? The amount that ends up maximizing his revenue.

If the government has the authority to take any percentage of your income, then everything you make effectively belongs to the government, and the government lets you have some of it as an incentive to get you to bring in more. How much does it give you? The amount that ends up maximizing its revenue.

So you can think of yourself as paying a 37% tax on your income; or as getting a 63% commission on the government’s income. The former is more comforting. But what the arbitrariness of tax rates teaches us is that the latter is more accurate.

So why bring this up? Two reasons. First, we’re going through a period where many people are becoming aware for the first time of just how capricious and arbitrary government policies really are. So this seems like an appropriate time to toss a little gasoline onto that fire.

Second, although New Hampshire has no state income tax now, it’s only a matter of time until reckless state spending paints us into that corner. And when we do… well, as Confucius noted, the first step towards wisdom is to call things by their right names. Talking about taxes will lead us in one direction; talking about commissions may lead us in quite another.