The House Ways and Means Committee voted on the Education Tax Credit (ETC) repeal bill, HB 632, earlier today. We blogged their discussion on our Facebook page; you can see a series of posts dated March 13th to follow along.

The motion to pass the bill was made by Rep. Thomas Southworth, seconded by Rep. Lisa Bunker. Immediately, Rep. Jerry Stringham introduced an amendment that would greatly reduce the tax credit from 85% of Business Profits or Enterprise Tax to only 10% because he does not understand how the tax credits are allocated to donors. He incorrectly thinks businesses make a profit from the donations even though that was refuted in the public hearings. Rep. Charles Burns characterized this amendment as a “slower death” to the scholarship program instead of the instant one as proposed in the original bill.

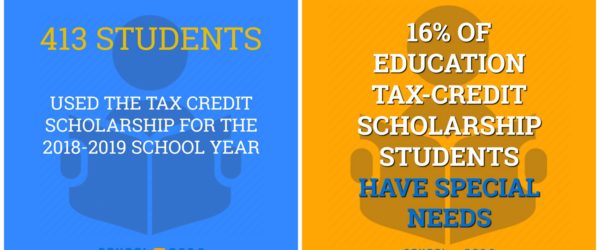

Rep. Jennie Gomarlo asked why the ETC program has raised only $1.2M instead of amounts closer to the $5M cap and Chairman Susan Almy made the absurd statement that “businesses are concerned about the scholarships going to religious institutions.” Rep. Jess Edwards immediately asked to have Kate Baker from the Children’s Scholarship Fund NH address that concern. Ms. Baker stated that there are two barriers: 1) that many businesses are unaware of the ETC program, and 2) the donation process is bit cumbersome. As an example, potential donors need to make estimations about the taxes they expect to pay and the process is not available online. She also reminded the committee that it would be discriminatory to exclude religious schools from school-choice programs.

The committee then voted on the amendment, which failed.

Read More and take action at School Choice for NH