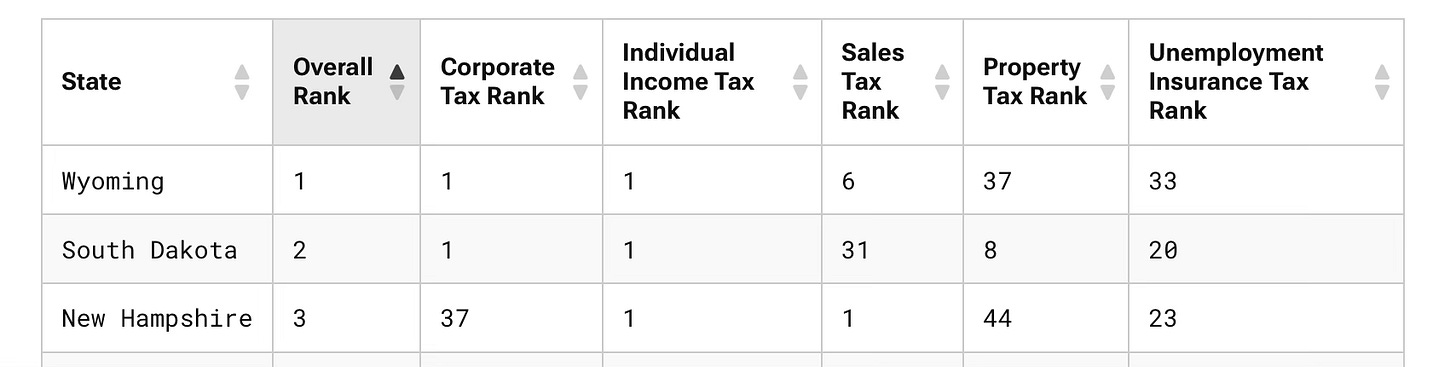

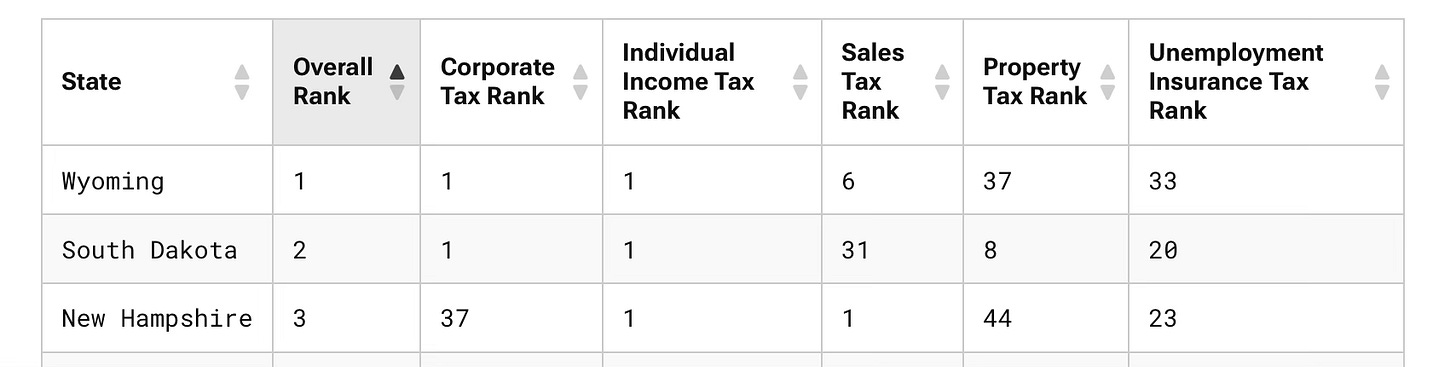

Policy debates in New Hampshire are remarkably superficial. For example, an organization called the Tax Foundation recently released its “State Tax Competitive Index”, which scored New Hampshire the third-best State:

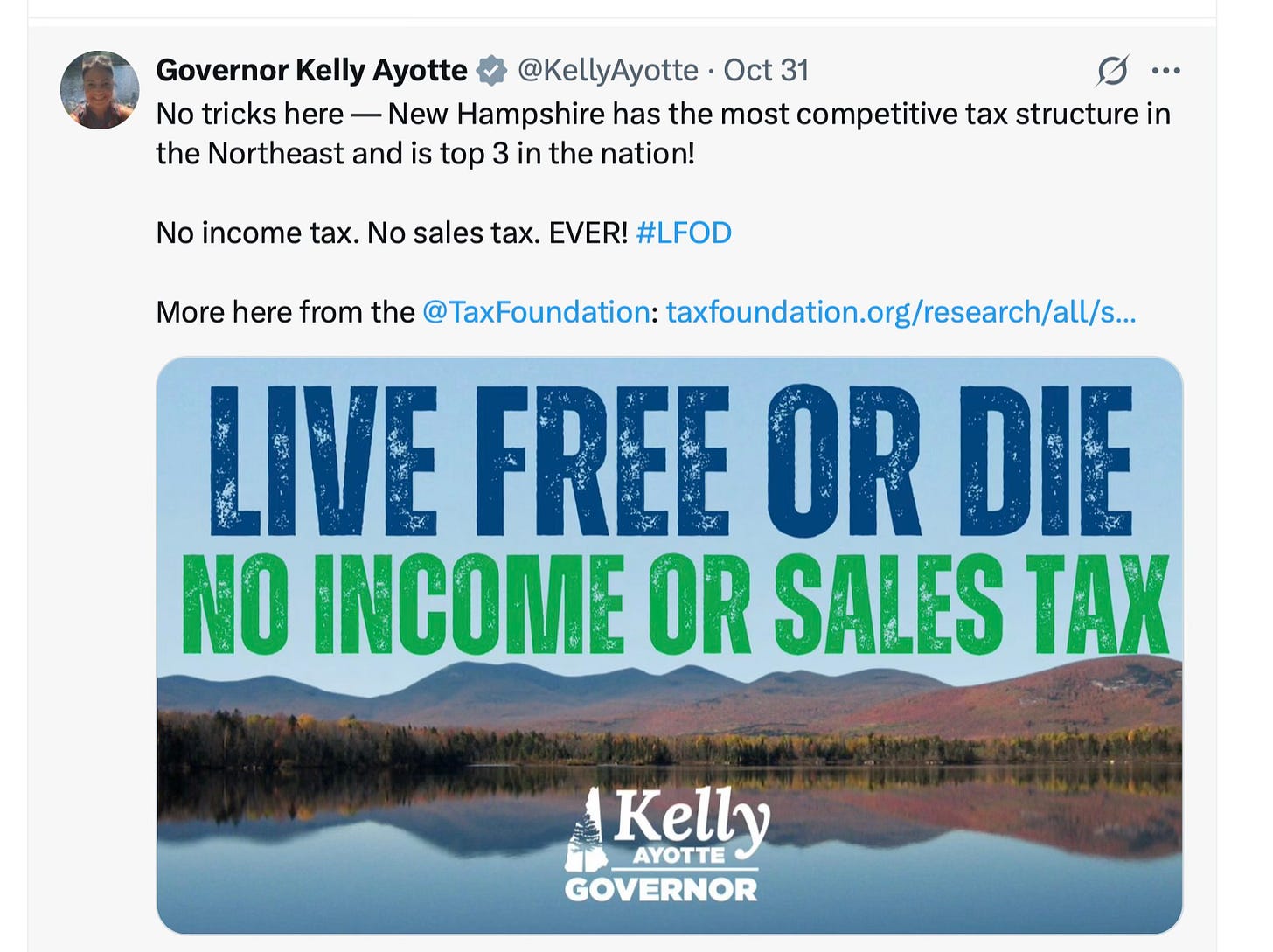

But should New Hampshire’s tax policy be to achieve as high a rating as possible on the Tax Foundation’s “competitive index”? The Governor, the local Koch organization, and GOP State Reps appear to think it self-evident that it should. For example:

The Tax Foundation’s “competitive index” is a subjective, not an objective, standard. That is, it represents the opinion of the individuals and/or organizations that control the Tax Foundation. New Hampshire rates highly on the “competitive index’ because the Tax Foundation prefers funding government with property taxes, sales taxes or business taxes over income taxes:

The “competitive index” does not correlate to economic performance. As you know if you read New Hampshire’s Koch Business-Tax-Cuts Have Been A Bust, Massachusetts’ economy has grown more than New Hampshire’s over the past decade:

New Hampshire’s economy expanded by 19%, Massachusetts economy grew by 23% ($514.4 billion to $633.62 billion (Statista)).

Yet the “competitive index” rates Massachusetts only the 43rd most competitive State. The Tax Foundation concedes that a State’s business climate depends on a multitude of factors besides taxes:

The Index measures tax structure, not all the other things businesses care about, like an educated workforce, quality of life, proximity to relevant markets, or even the weather …

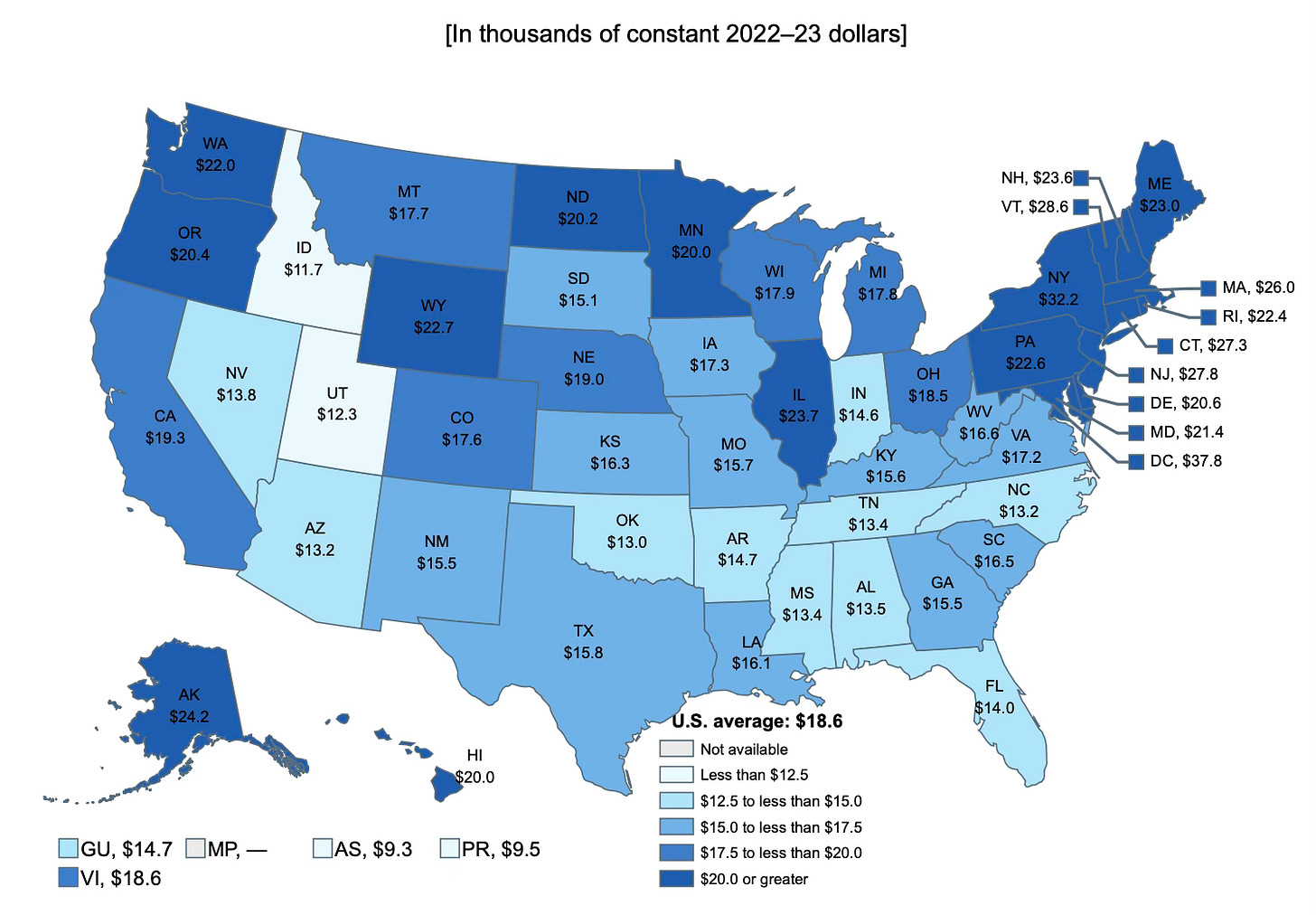

New Hampshire’s current tax structure has not prevented, and one can persuasively argue has contributed to, the Granite State spending far more on public education on a per pupil basis than most other States:

Shouldn’t we be discussing whether New Hampshire’s current tax structure, and in particular its heavy reliance on property taxes to fund public education, can be improved? Information such as the Tax Foundation’s “competitive index” should inform the discussion, not be the end of the discussion.

Some other things. First, Greg Koch (aka Greg Moore)’s claim that New Hampshire is “income tax free” is debatable. The BET (Business Enterprise Tax) is an indirect income tax. Businesses composed of professionals such as lawyers, architects, etc. avoided paying BPT (Business Profits Tax) by paying out all the profit as salaries. The BET was passed to counter this behavior by taxing the payrolls of businesses that report no profit.

It is also worth noting that prior to Koch, the Interest-and-Dividends Tax was not considered an income tax. The “pledge” pertained to a “broad-based” income tax, i.e. a tax like the federal income tax that sought to tax income from all sources.

Second, Kelly Ayotte’s claim that New Hampshire has no sales tax is false. The Room-and-Meals Tax is a targeted sales tax. It is inconsistent, if not hypocritical, to claim that the Interest-and-Dividends Tax is an income tax, but the Room-and-Meals Tax is not a sales tax.

Finally, we have to note that many of the same people telling us New Hampshire needs to import younger residents (build, build, build) because it is too old-and-gray also supported abolishing the Interest-and-Dividends Tax … which presumably has attracted and will attract the very old-and-grey that there are allegedly already too much of.

Authors’ opinions are their own and may not represent those of Grok Media, LLC, GraniteGrok.com, its sponsors, readers, authors, or advertisers.

Got Something to Say, We Want to Hear It. Comment or submit Op-Eds to steve@granitegrok.com