It’s that time of the year again when the School and Town budgets are presented to taxpayers at the town meetings. This is the time to ensure you are part of the process so your elected representatives understand what you expect from them. Pembroke voters rejected a $3 million dollar school budget last year, indicating that taxpayers seem to be saying, enough is enough.

You can look at the performance of your school on the New Hampshire Department of Education website. Click on this link, and then plug in your school district from the drop-down list. (Select a School or District) Then click View Report.

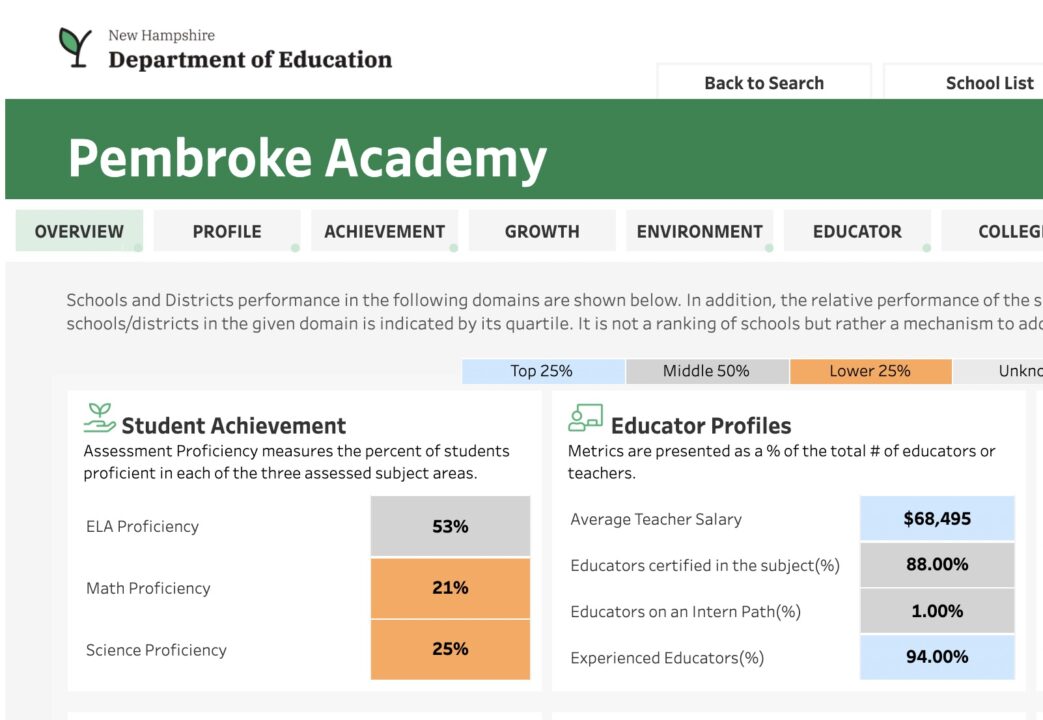

For Pembroke Academy, this is how students performed on the State Standardized Test:

.

As you can see, about half of the student population are proficient in English Language arts, and about a quarter of the students are proficient in Math and Science. Budgets are going up, but student proficiency scores do not seem to be following that same pattern in many school districts around the state. These schools have all the bells and whistles you can view on their website, but they cannot manage to educate their students to proficiency in the core academic subjects.

If you look at the proficiency scores in the high schools across the state, you’d be hard-pressed to find any high schools where the vast majority of the students are scoring proficient in Math. Bedford shows 55% of their high school students scoring proficient, while 36% of Winnacunnet students scored proficient in math.

Elementary and middle school students seem to be doing slightly better, but even in my district, SAU21, we are seeing a significant disparity between North Hampton, where 70% of students scored proficient in math, while only 38% of students scored proficient in math at Seabrook Elementary.

Budgets go up, but taxpayers keep asking, what are they getting for their money?

I addressed the school board in Seabrook a few months ago, pointing out some of the areas I believe they should be looking at. The math program Seabrook uses is Eureka2. Eureka2 is Common Core aligned, embedded with SEL (Social and Emotional Learning), and infuses art in the math program. One might be asking, where’s the math?

Access the Seabrook Oct. 8th school board meeting here, where I address all of their core subjects, including Eureka2. Begin at 45 min.

Eureka2 also requires teachers to use an inquiry approach to learning in the classroom:

“”Eureka Math 2″ incorporates inquiry-based learning by providing a structured curriculum that encourages students to actively explore mathematical concepts through problem-solving, reasoning, and discussion, allowing them to discover and construct their own understanding of math rather than simply memorizing facts; this approach is facilitated by open-ended questions, multiple representations, and opportunities to justify their thinking within the lessons.“

When students have to discover math instead of learning the academic content from a teacher, this creates all kinds of problems for the students. It’s one of the biggest reasons parents then have to teach their children at home or higher math tutors. This approach to learning has been debunked as one of the worst ways for students to learn math. Unfortunately, this approach to learning continues in many classes. You can see how teacher-centered or direct instruction helps children learn math here and here.

This might be why so many schools have to now hire math interventionists. The programs they buy with taxpayer dollars fail students, then the teacher is told that they need to use a student-centered approach to learning where students discover math. Once that fails, school administrators hire additional staff to make up for those deficiencies.

Students do not discover math; they need to be taught math. Families can make up for that deficiency at home if they understand the confusing Common Core math. Families can also hire tutors who will teach their children the content. If they do not have those resources, children will begin to fall through the cracks.

Seabrook residents also turned down the proposed budget during the last election. Maybe investing in poor-quality math programs using poor-quality pedagogy caused poor math proficiency.

What can you look at when you look at your school budget?

What kind of expenditures raise the budget but do not really help the students in the school?

Here are some things to look for now before the Deliberative Session:

1) Do you pay dues to the NH School Boards Association AND NH School Administrators Association?

Both of these organizations pay lobbyists that do not represent you or the taxpayers in the district, yet you are paying their salaries through the dues that come out of your school budget.

2) Professional Development for teachers that is not focused on academic.

PD provided can be focused on political agendas. Seacoast Outright, for example, is a political organization that is now coming into the schools to spread their radical political agenda to teachers through PD.

3) How many additional administrators have you hired over the past five years?

4) How many social workers, counselors, and school psychologists have you hired over the past five years?

This number seems to be increasing as schools become mental health clinics.

5) Has your school turned into a School-Based Health Clinic?

Amoskeag is now working with Manchester students. What is that costing taxpayers? Obamacare was marketed as a way to provide health coverage to children without insurance. Now taxpayers are funding SBHC’s.

6) What do the administrators at the SAU do, and how much do they make?

There’s a lot of busy work being done by administrators making 6-figure salaries. Projects like Portrait of a Learner took a great deal of time to prepare, but none of this improved academics in the school.

LOOK at what YOUR SAU administrators are paid here. Then, compare those figures to what the NH Governor, Attorney General, and Commissioner of Ed make here.

As you will see, most School administrators working for your SAU earn more than the Governor and Attorney General in New Hampshire. Maybe their salaries need to be more in line with some of our executives working for the State of New Hampshire.

Beware also of those proposing a sales or income tax to relieve the property tax burden. That will create another tax on top of what you are already paying. The answer is to become more efficient, without sacrificing the quality you expect from your school system.

Now is the time to ask to see details in your school and town budget. If they are inefficient with your tax dollars now, chances are they will continue that practice if you provide them with more money.

Look for ways to improve public education without wasting money. A simple change in how you teach children math can have a significant impact on academic outcomes.