Nine years after the state began reducing business tax rates, five narratives are driving the policy discussion of those cuts. All five are false.

In a new briefing paper, we debunk the five most common myths about the business tax cuts that ran from 2015-2022.

Background: From 2015-2022, legislators cut the Business Profits Tax from 8.5% to 7.5% and the Business Enterprise Tax from 0.75% to 0.55%. Opponents predicted that the cuts would starve the state of revenue, resulting in defunded programs, lower public school spending, and reduced aid to local governments.

Those predictions continue to be asserted as fact. Official state data prove them false.

Note: State spending numbers extend through FY 2025, but audited revenues are complete only through FY 2023. For that reason, we use revenue data only through FY 2023.

Myth No. 1: Business tax cuts resulted in lower business tax revenues.

Fact: Revenues from business taxes have more than doubled since the tax cuts began, rising by 124% from state Fiscal Years 2015-2023.

Source: State Comprehensive Annual Financial Reports, 2015-2023.

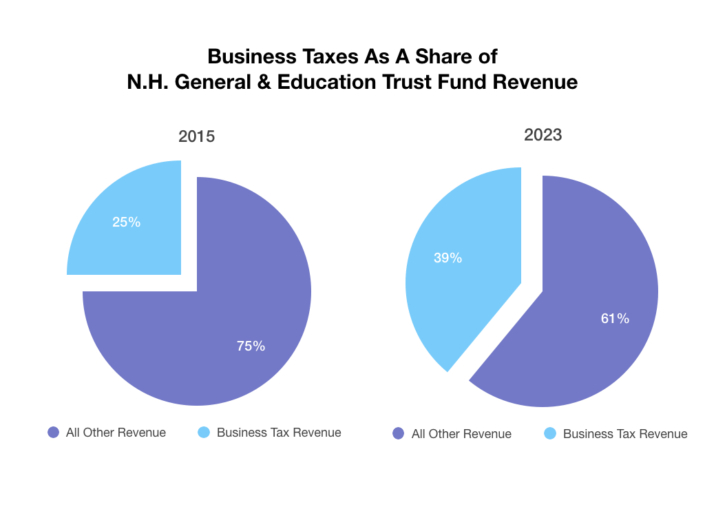

Myth No. 2: Business tax cuts reduced the share of state revenues paid by businesses. (“Businesses aren’t paying their fair share.”)

Fact: The share of state tax revenues generated by business taxes rose by 56% from 2015-2023. The share of total state revenues, including federal funding, paid by businesses rose by 40%.

Source: State Comprehensive Annual Financial Reports, 2015-2023.

Myth No. 3: Business tax cuts resulted in lower state aid for local governments and public schools.

Fact: State aid to local governments increased by $214 million from Fiscal Years 2015-2025, or 19%.

Source: Office of Legislative Budget Assistant report, “State Aid to Cities, Towns and School Districts Fiscal Year Ending June 30, 2024,” Oct. 1, 2024.

Myth No. 4: Business Tax Cuts reduced aid to public schools, resulting in property tax increases.

Fact: State aid to public schools increased by 15% from 2015-2024. (Both adequate education grants and total aid to public schools increased by 15%.) At the same time, public school enrollment fell by 16,373 students, or 9%, resulting in average per-pupil state aid rising by 26%, from $5,115 in 2015 to $6,469 in 2025.

Source: Office of Legislative Budget Assistant report, “State Aid to Cities, Towns and School Districts Fiscal Year Ending June 30, 2024,” Oct. 1, 2024, Department of Education Average Daily Membership reports, 2014-2024. *State adequate education aid is based on the prior year’s enrollment.

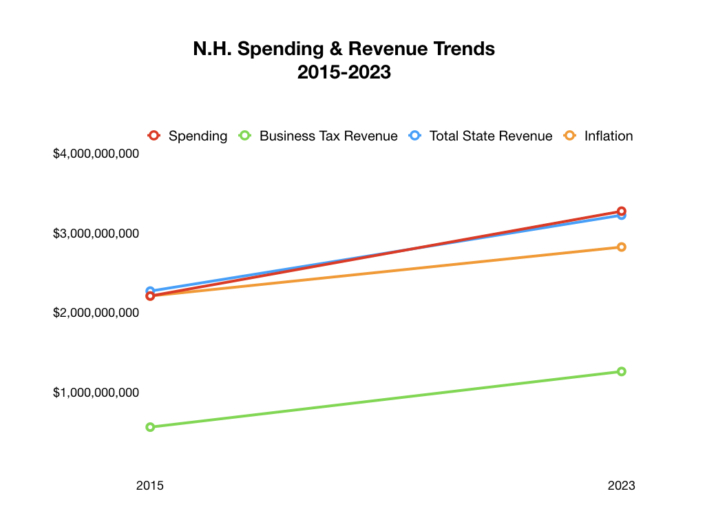

Myth No. 5: Revenue declines caused by business tax cuts are the reason for projected revenue shortfalls in Fiscal Year 2025.

Fact: Business tax revenues and total state revenues are dramatically higher, not lower, since 2015. However, from 2015-2025 legislators increased spending to match revenues. Had spending simply grown at the rate of inflation, slower revenue growth would not be an issue in 2025.

Note: “Total State Revenue” in the chart below refers to revenue from state sources, excluding federal funds.

Download this briefing paper here: Business Tax Cut Myths 2024.