Carbon sequestration is now common climate change parlance for processes that remove carbon from the atmosphere and store it either in organic matter or geological formations. But is it really as good as it sounds? The first method, also called rewilding, involves growing trees. The second, geological sequestration, involves a massive industry, pipelines, and the pumping of millions of tons of pressurized liquid carbon dioxide under the ground for long-term storage. Critics caution that profits are being favored over potential risks to the environment and human health from these technologies.

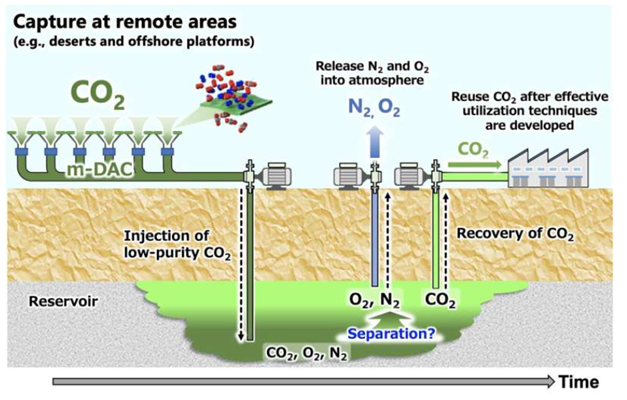

Geological carbon storage collects industrial carbon dioxide from petroleum, fertilizer, steel, and other industrial facilities and compresses it into a 90% CO2 liquid. Then that’s pumped into subsurface formations including coal seams, porous rock, aquifers, or depleted oil and gas reservoirs. Companies are awarded tax credits for this. Credits are highest for CO2 captured and stored permanently, and a lower credit is available for liquid carbon that is used in enhanced oil recovery, which is when the pressurized carbon is pumped back into oil wells to increase production in reservoirs that are depleted or hard to access.

Critics argue this practice is insufficiently studied and that it may cause earthquakes or other unintended geological events. Other concerns include proper monitoring, non-CO2 contaminants that may taint groundwaters, aquifer pollution, and the potential for escape. Advocates claim the oil and gas industry is well acquainted with the technological challenges and can be trusted to regulate this new process.

Carbon Meets the Tax Code

Examining the US Tax Code offers some above-ground clues about what is going on down below: Tax credits for carbon capture are big business. The existing credit system was substantially expanded by the Biden Administration under the Inflation Reduction Act (IRA), ensuring this lucrative industry will thrive.

IRS regulations concerning carbon storage (45Q) credits reveal several problems. How can the government ensure that liquified carbon will not seep back into the air? How will it measure that process if it occurs? And what happens to the huge 45Q tax credits paid out in the event a company’s carbon is “un”-captured and released back into the atmosphere?

Small Farm Republic is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

The answers to these questions are revealed in the US Tax Code, which requires companies to repay 45Q tax credits if/when “sequestered” carbon un-sequesters itself and escapes. IRS Bulletin 2021-16 §1.45Q-5(a) states “a recapture event occurs when qualified carbon oxide for which a section 45Q credit has been previously claimed ceases to be disposed of in secure geological storage….” That phrase “ceases to be disposed of” translates into “leaked” and is only recognized if the amount leaked exceeds the amount allegedly stored. IRS Bulletin §1.45Q-3(b) defines this:

“Ceases to be disposed of in secure geological storage or used as a tertiary injectant. Qualified carbon oxide for which a section 45Q credit has been previously claimed ceases to be disposed of in secure geological storage (as described in §1.45Q-3(b)), or used as a tertiary injectant, if the leaked amount of qualified carbon oxide in the taxable year exceeds the amount of qualified carbon oxide securely stored in that same taxable year.”

Clearly, the IRS anticipates leakage from sequestration sites. It has a specific recapture provision to claw back tax credits when this happens, but the “lookback” period (§1.45Q-5(f)) is only three years! This means that if companies lose the carbon dioxide they were paid to sequester because it leaks back into the sky, they never have to repay more than the previous three years’ 45Q credits!

Hazardous Scheme

There are numerous moral hazards percolating through this 45Q scheme. Three years after closing a site, what incentive do companies have to keep the carbon sequestered or monitored? What is to prevent companies from discharging toxic waste as effluent?

If carbon dioxide does spill back into the environment, §1.45Q-5 (c) details how the release is to be measured: “…the quantity determined pursuant to CSA/ANSI ISO 27916:2019 must be certified by a qualified independent engineer or geologist” in accordance with “sound engineering principles.” How on Earth can the amount of carbon dioxide seeping up from underground aquifers possibly be accurately measured? And what if leakage impacts vital water supplies, where carbon dioxide can cause the release of toxic minerals?

In the name of saving the planet, many technological ventures are being launched that guarantee massive profits without ensuring results. Underground carbon dioxide sequestration is praised as a necessary cure-all, but it drains the nation’s coffers while potentially contaminating aquifers – and all with no guarantee of effectiveness. This is not good fiscal or environmental stewardship.