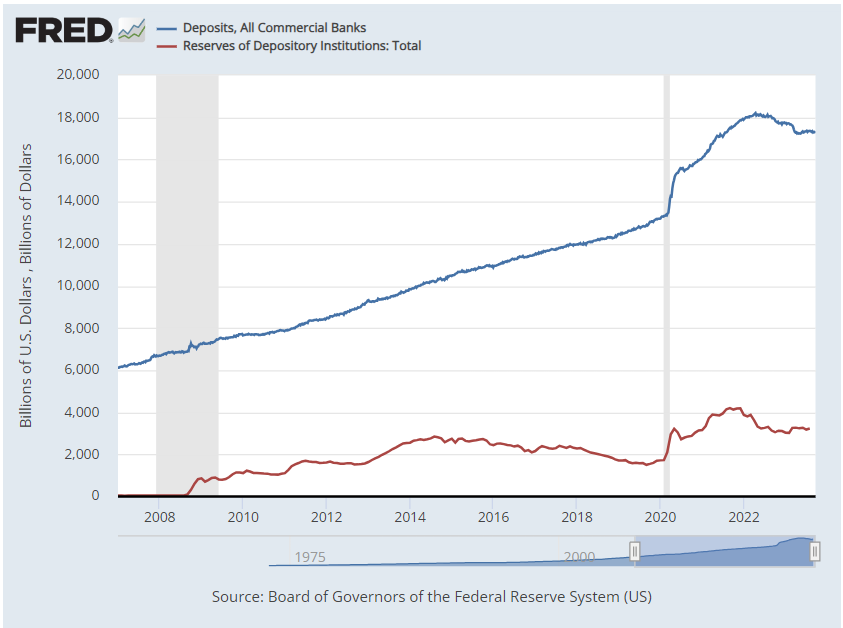

When Silicon Valley Bank and other banks failed earlier this year, the debate over the sustainability of fractional reserve banking resurfaced. Under fractional reserve banking, banks keep only a fraction of customers’ deposits in reserve. The difference is bank credit, such as government debt, mortgages, business loans, and many other kinds of loans. This practice leaves the bank open to a run, in which panicky depositors attempt to withdraw their funds from the bank en masse, but the bank doesn’t have the cash on hand. The following FRED graph gives an idea of the extent of the mismatch between deposits and reserves.

But we shouldn’t worry about bank runs because the government is here to help. In the US, the Federal Deposit Insurance Corporation (FDIC) insures checking accounts up to $250,000, and the banking system is regulated by a host of agencies, including the Federal Reserve, which also acts as a lender of last resort. These measures are intended to prevent and mitigate bank runs for the benefit of both the banks and their depositors. Though it should be obvious that they only conceal the fundamental problem and disperse the costs.

Murray Rothbard was a detractor of fractional reserve banking. He wrote on the changing legal definition of bank deposits—how they originated as warehousing relationships, or “bailments,” but over time came to represent debtor-creditor relationships. Ludwig von Mises also pointed to bank issues of fiduciary media (the proportion of deposits that cannot be redeemed), which artificially lower interest rates, as the cause of business cycles.

Nevertheless, a faction of Austrian and Austrian-adjacent scholars defends fractional reserve banking, saying that not only can it be sustainable, but it can also be beneficial in maintaining monetary equilibrium. I’m not convinced by this view, but it’s worth taking a closer look at one point that these scholars often make. They say that clear communication between the bank and its customers would solve the hairy problem of bank customers expecting the money at par on demand.

With such an agreement, “fractional reserve free banking” proponents say depositors would know that they are effectively creditors to the bank and that the bank is, therefore, a debtor to them. This means that the deposits are technically and legally owned by the bank and that what the depositor has is technically and legally a callable loan to the bank. Clear agreements would mean that depositors understand that there is a chance that they won’t be able to get their money (actually, the bank’s money, in this view) immediately in the event of a bank failure. Of course, central banking and government-backed deposit insurance diminish customers’ expectation of bank responsibility—how much should banks be expected to disclose about the deposit relationship if most of their customers’ deposits are guaranteed by the government anyway?

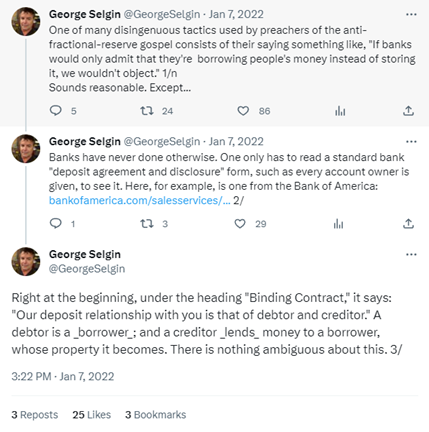

In line with other fractional reserve-free banking proponents, George Selgin argues that modern depositor agreements—the dense legalese most people skip—already establish this transparency.

And he is right. Bank of America does make that disclaimer in its deposit agreement. I decided to take a closer look at other big banks’ fine print to see how standard this language is. What I found is that it isn’t standard and that even when a bank (including Bank of America) does use that language, it is still ambiguous because of other language in the document, especially in regard to the availability of funds. One bank’s fine print doesn’t even mention the possibility of bank failure and FDIC receivership.

Here is what I found.

JPMorgan Chase does not have debtor-creditor language. In fact, in the first section of the agreement, in which common terms are defined, it says that the “available balance” is “the amount of money in your account that you can use right now.” This does not indicate that Chase “owes” its customers the money or that withdrawals could be delayed. Chase explicitly calls its deposit customers “account owners” and say they have “complete control over all of the funds in the account.”

Bank of America describes the deposit relationship as “that of debtor and creditor,” but this language does not appear in its online banking service agreement, which only says that the online “Services may also be affected by your Deposit Agreement.” Bank of America doesn’t say much about the availability of demand deposits but is very clear about time deposits: “When you open a time deposit account, you agree to leave your funds in the account until the maturity date of the account.”

Wells Fargo does not use the debtor-creditor language to describe its deposit relationship. Like Bank of America, Wells Fargo says that account owners have “complete control over all of the funds in the account.”

Citibank very clearly defines its relationship with customers: “Citibank’s relationship with you is debtor and creditor.” But Citi also refers to the customer’s balance as the “‘Available Now’ balance,” even though a critical mass of depositors could run to withdraw their funds and find that the money isn’t so available.

US Bank does not use the debtor-creditor language to describe the deposit relationship. In fact, early in the agreement it refers to the “Owner’s Authority” of depositors, which includes “the power to perform all the transactions available to the account.” US Bank also says that the customer’s funds are available immediately: “‘Available Balance’ means the amount of money that can be withdrawn at a point in time.”

PNC does not use the debtor-creditor language to describe the deposit relationship. It does not even have a section on the possibility of bank failure and the process of FDIC receivership, which is in all the above banks’ deposit agreements.

So, only two of these six major banks have the debtor-creditor language, and the two that do have it introduce ambiguity by promising at-par-on-demand availability of funds. We are still a long way from clear communication about the status of depositors’ money, if we can call it theirs at all.