Silicon Valley Bank took in deposits from businesses and households. It then loaned out some of the deposits. When a bank loans out deposits, it earns a return (profit), because the bank charges “interest” on the loans. All banks do this. But SVB made a big mistake.

We want to thank Pamela J. Brown, Ph.D. (Economics), for this Contribution – Please direct yours to Editor@GraniteGrok.com.

It loaned out tens of Billions of Dollars by purchasing long-term U.S. Treasuries.

Yes, U.S. Treasuries are considered very safe for investing because the government has the coercive power to tax to refund the loan (a good thing for banks!).

But SVB bought Treasuries that were 1) long-term and 2) at that time, offered a very low-interest rate.

Recently, our monetary authority, the Fed, decided to RAISE interest rates. That means interest rates for any newly-loaned money, including money the govt. decides to borrow (via U.S. Treasuries) will now take place at a HIGHER rate.

So, SVB is holding investments promising a low-interest return in the future. To “equalize” the value of the low-return Treasuries they hold with today’s higher-return Treasuries, SVB must sell their Treasuries AT A LOWER PRICE if they want some cash.

When SVB customers such as Etsy (an online platform for small-business entrepreneurs) tried to withdraw funds to make monthly payments to their employees and platform users, SVB was forced to sell their Treasuries to return the money. This happened at a loss because of the interest rate difference in old-versus-new Treasuries in circulation.

Etsy just had to freeze all transactions because SVB’s balance sheet isn’t balanced: assets (the US Treasuries held) have not been sufficient to cover liabilities (customer deposits).

Now, SVB is closed.

One could say the Fed “tricked” SVB when it raised interest rates and made its investments of lesser value.

If interest rates had remained stable, the situation would not have arisen.

But SVB’s managers should know enough to avoid over-investing in long-term Treasuries. When price inflation rose to 9%, the Fed decided to raise interest rates to contract the money supply and lower prices. Changing government policies are just one of the risks that affect a bank. Financial institutions must be careful to diversify how they invest deposits.

Not all bank failures are caused by reckless government policies. During the Dust Bowl, loans made to farmers were not repaid in part due to prolonged drought, and deposits were lost. That’s life, and those are called supply shocks. But in this case, we can ‘thank’ continued mismanagement in Washington and the Federal Reserve’s jacking with interest rates to accommodate budget chaos for the chronic volatility we’re seeing.

SVB’s situation may cause more banks to fail.

Millions of people are wondering if their banks are over-invested in lower-value assets such as long-term Treasuries. If people develop concerns about their bank’s financial health, whether real or imagined, they will wonder if sufficient funds are available to depositors.

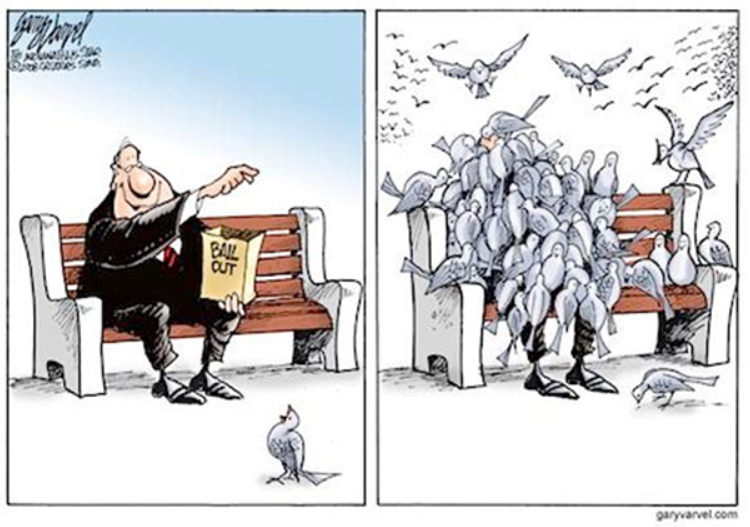

This may lead depositors to hurry in to retrieve their money, called a “run on the bank.” When millions do so, it’s called a “contagion.”

Any depositor with $250,000 (or less) in most US banks is protected with FDIC insurance. By law, they will see their money returned. The problem is that many had deposited MILLIONS in SVB – far exceeding the $250K insured amount.

“90% of SVB’s deposits [are] in financial limbo…that includes Roku, which said it has nearly $500 million with SVB.”

That was a risk that Roku took. I do not support the government (read: taxpayers) providing a bailout to SVB and its depositors.

Lesson learned: Do not deposit more than $250K in any one bank. If you are lucky enough to have more than $250K in cash someday, spread it around to a variety of banks and credit unions and keep the amounts you deposit below the $250K insured limit.

Pamela J. Brown, Ph.D. (Economics)