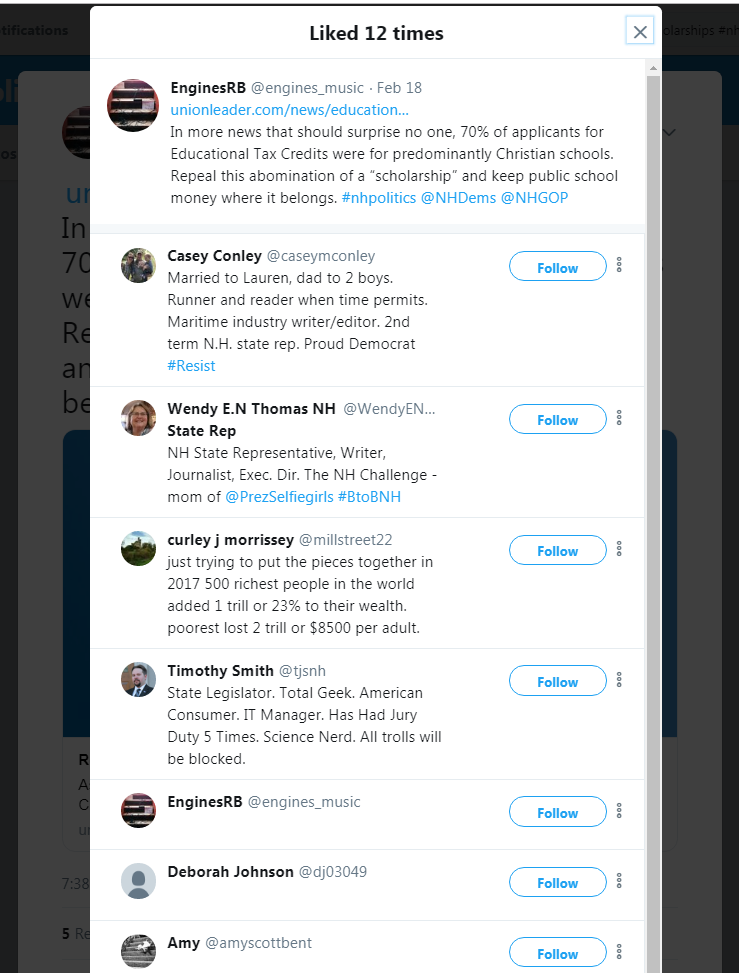

Merrimack, New Hampshire Democrat Wendy Thomas recently showed her support for a form of religious bigotry by liking a tweet responding to a local news piece about New Hampshire’s Education Scholarship Tax Credit. The tweeter wrote, “repeal this abomination of a “scholarship” and keep public school money where it belongs.”

New Hampshire has several similar programs that allow businesses to earn tax credits. There’s the Coos County Job Creation Tax Credit, the Research & Development Tax Credit, and the Economic Revitalization Zone Tax Credit. We’ve also got an Education Scholarship tax credit.

Business owners invest or donate their own money into one or more of the above, and in return, the state of New Hampshire allows them a credit against their State business taxes.

New Hampshire Democrats are fine with these schemes except when it comes to education.

They want to repeal the Education tax credit. Why? One of their favorite reasons is the separation of church and state. Private money donated by private business owners might be used to pay for tuitions to religious schools. So, Democrats are working on legislation to scrap a program that allows low-income families to send their kids to private or charter schools that are a better fit for their kids. Schools they would not otherwise be able to afford.

Some of them are religious schools. Democrats can’t help but hate this.

But the Federal government allows individuals, including business owners, to deduct direct donations to a wide range of organizations, including religious charities or even the family church.

So, is Wendy Thomas planning to propose legislation banning federal deductions by private citizens who donate to religious organizations or charities from New Hampshire? If not, why don’t those dollars also belong to public schools?

How is not being able to tax those dollars not a violation of the left’s blessed obsession with the separation of church and state?

Is this About Money or Control?

That aside, does Democrat Merrimack State Rep Wendy Thomas agree with the premise that the money of private citizens belongs to the government first?

Should the state legislature pass laws prohibiting one tax credit over any other on religious grounds? Is Thomas advocating a religious test on public giving? Or, for parents who wish to allocate private donations for the betterment of their own children? All because this private money might end up in the hands of some religious organization?

Private money Democrats didn’t get to tax?

Over 400 low-income New Hampshire families took advantage of this program in the last school year. Does Thomas believe it is an abomination or that these parents are not adequate guardians for choosing religious schools for their kids? Even when geographically that school may be the only other available option?

And why would Thomas only impose this elitist constraint on low-income families or underprivialged kids? Does she intend to support legislation to deny wealthy families the right to send their children to private schools or religious schools? Why don’t those dollars belong to public schools?

Is this a move to mandate education socialism in the Granite State? When did the government earn the right to a monopoly on educating children? How is that not, after a fashion, a more dangerous and constraining form of zealotry? An institutionalized intolerance backed by the power of the state?

And why would Democrats and Wendy Thomas work so hard to trap (primarily low income) kids in underachieving public schools that might not be the best fit? What do Democrats gain by doing this?

If you are going to support repeal of this one tax credit, even partially on religious grounds, you and your fellow Democrats owe Merrimack residents and New Hampshire families an explanation.