The Live Free or Die State is anything, but -New Hampshire’s State Budget is top-heavy with Federal Money. This dependence is embarrassing and debilitating, but recent tax cuts have produced a wave of new revenue. And cutting more taxes sounds great, but I may have a better idea.

Revenues

And now we’re back to the Scott Dunn Monument to Economic Illiteracy (otherwise known as the Gilford Recycling Center) – Part 2

Well, I’m not letting the speed of return responses from my Right To Know requests get the better of me yet although I AM pleased that they aren’t being slow rolled. To recap, what I asked for: Revenues to date for this fiscal year (GL account line item for the last budget process: 01-3404-917) Fees … Read more

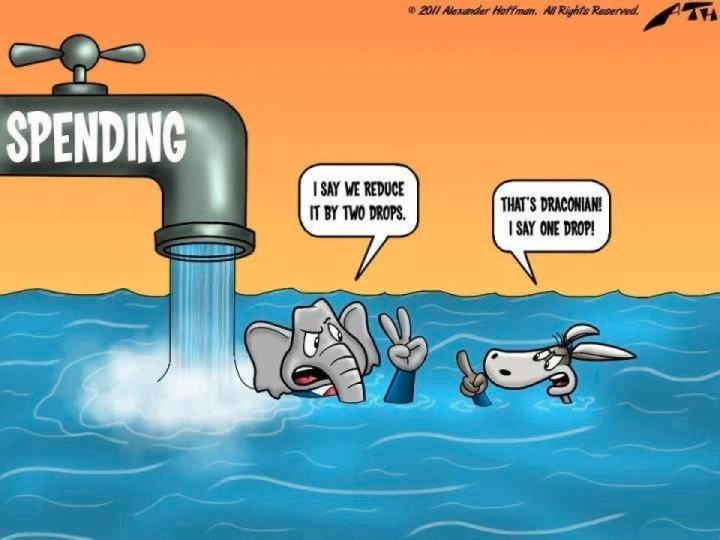

Data Point – The US has a SPENDING Problem, not a Revenue Problem

The United States has a SPENDING problem, not a revenue problem. So, how much did the US take in?

New Hampshire’s “Crumbs” – Federal Tax Reform Produces “Abnormal Rise” in Business Tax Revenue

This week the New Hampshire Fiscal Policy Institute (NHFPI) issued some analysis on the “abnormal rise” in New Hampshire Business tax revenue. Their conclusion? It is likely due to Federal Tax Reform.

This week the New Hampshire Fiscal Policy Institute (NHFPI) issued some analysis on the “abnormal rise” in New Hampshire Business tax revenue. Their conclusion? It is likely due to Federal Tax Reform.

As of the end of April, the BPT and BET together are about $90.8 million (16.9 percent) above plan for the year, and $107.0 million (20.6 percent) above April 2017. Although these two business taxes have been the primary source of the surplus during the year, the post-TCJA rise has dwarfed other revenue sources, even those that are major contributors.

NH TEA Party Republicans Better At Revenue & Spending Estimates Than Democrats…Again

I know… New Hampshire Democrats were losing sleep in hopes of some politically-beneficial revenue numbers, and guess what? They were politically beneficial….To TEA Party Republicans.

I know… New Hampshire Democrats were losing sleep in hopes of some politically-beneficial revenue numbers, and guess what? They were politically beneficial….To TEA Party Republicans.

The Union Leader is reporting that New Hampshire state revenues were slightly above estimates in July, with solid performances that suggest we are budgeting wisely so that the working families and small business owners in New Hampshire can continuing to drag us out of the economic quick sand in which Democrat tax and spend polices have had us trapped.

So How well did the TEA Party Republicans manage your money for July 2012?

The NH Democrat’s Dishonesty About Tobacco

On 6-6-12 I provided an update on the state of tobacco tax revenue in New Hampshire. Buried in that post were some observations about how hypocritical and dishonest Democrats in the Granite state are about tobacco and their obsession with taxing it. A hypocrisy they themselves may not even grasp. So I wanted to excerpt that portion separately with a few minor edits. Here it is.

Democrats complained publicly and often about lower tobacco revenue after the tax was first lowered. But isn’t that the point of the tax? To lower consumption and therefore revenue? To end a practice many in government, and more so in the nanny wing, argue adds to the long term cost borne by the public? Is that not the goal? To make smoking history?

And we know that raising the tax reduces consumption, and lowers traffic into New Hampshire to buy tobacco (and anything else) because we’ve seen it happen. So less tobacco revenue always had to be the goal for Democrats if they are being even remotely honest about it. This means that at some point New Hampshire was going to have to look someplace else for that revenue–or were NH Democrats planning on increasing the tax per pack on the last smoker to $30 million (or whatever it is) to make up for everyone else who had quit at their urging?

Do you see how stupid that logic is?

“Oh Crap” Sayeth the NH Left, Tobacco Revenue Over Projection….Again.

Nothing makes me smile like watching another left wing New Hampshire Democrat narrative go up in smoke. Which narrative, you ask, there are so many to choose from? Why, the one about how irresponsible it was to cut the tobacco tax and how it would never stimulate enough other forms of cross border commerce to make up the difference. A notion that is not just backwards, it runs counter to the entire concept of the New Hampshire advantage.

Nothing makes me smile like watching another left wing New Hampshire Democrat narrative go up in smoke. Which narrative, you ask, there are so many to choose from? Why, the one about how irresponsible it was to cut the tobacco tax and how it would never stimulate enough other forms of cross border commerce to make up the difference. A notion that is not just backwards, it runs counter to the entire concept of the New Hampshire advantage.

So right out of the gate, the Democrats had no where to run on this issue–not that they didn’t try–and now things are looking bad for their tobacco tax narrative.

Left Wing “Fair Tax” In Trouble?

It is no secret that the Granite State Fair Tax Coalitions (GSFTC) is a hive of left wing Democrat tax and spend socialists trying to hide behind a so-called bi-partisan front group. It is run by leftists (here and here), colludes with leftists, and seeks to advance Democrat party tax policy under the false notion that our current system of taxation in New Hampshire is some how not fair.

But the evidence continues to confound their false narratives.

Despite the GSFTCs misrepresentation of facts and the spinning of data to mislead, whatever our tax system is in New Hampshire, it continues to provide a better quality of opportunity than any other state in the Nation. The US census reports that New Hampshire has the lowest poverty rate in the country.

Well how the hell did that happen? I thought things were so unfair here? How could our "unfair" tax system still allow for the best economic environment for people to thrive in? And in this lousy economy to boot? We have the lowest poverty, one of the highest standards of living, and one of the safest to live in as well. Could it be because our current system also provides one of the lowest overall tax burdens in the country as well? Can we argue that low overall tax burden–the result of our so-called "unfair" system of taxation, is somehow more effective at keeping people above the poverty line than any other state in the country?

Hell yeah.