RINO-Russ Barry, who prefers to be referred to as State Rep Ross Berry, wants you to believe that property taxes in New Hampshire are out of control because of “local control” of public school budgets:

First, there is no real “local control” of public education in New Hampshire. From an NHPR article:

State law RSA 193-E:3-b stipulates that schools demonstrate they are providing an adequate education by providing instruction in required program areas and by measuring student performance in accord with the accountability system, both of which are spelt out by statute.

The content of an adequate education is defined in statute RSA 193-E:2-a, which lists the required curriculum for elementary, middle and high schools.

The Minimum Standards are embodied in a comprehensive set of rules, known as the Ed 306 Rules, which together bear on every aspect of the education provided by public schools from the curriculum and content of instruction to the administration and operation of schools themselves.

Local voters do get to decide how much to spend to deliver the “adequate education” mandated by State statute and regulation, which results in some measure of “local control.” But the two main drivers of education spending, special education and bureaucracy, operate on autopilot.

Local voters have no control over whether a student is entitled to special education. Per the New Hampshire School Funding Fairness Project: In 2024, the average additional cost to educate a special education student in New Hampshire was $31,093. In contrast, the average cost to educate a student without an IEP (Individual Education Plan) was $18,719.

The State contributed, on average, only an additional $3,285 per student with an IEP, less than 11 percent of the extra cost. Even when State and federal funding are combined, local property taxes still fund 83.35% of special education. That’s over $800 million in local property tax burden that local voters have no control over.

Local property taxes would be materially lower if the State were, as it should be, picking up 100 percent of the tab for special education.

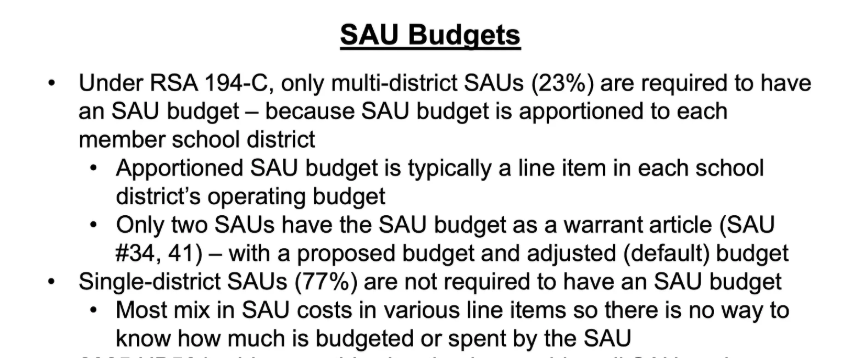

Another driver of education spending is the state’s SAU (School Administrative Unit) scheme, which requires every school district to have a SAU or belong to an SAU. As a practical matter, SAUs are black-holes sucking up who-knows-how-much taxpayer dollars.

The State law requiring every school district to have an SAU or belong to an SAU should be repealed. Local school boards can and should decide how to provide administrative support for public schools. The only State mandates should be complete transparency, so local voters can know precisely how much is being spent on administration and exactly how that money is being spent, as well as the ability to make specific cuts to administrative expenses.

Finally, we want to emphasize that a statewide tax cap is NOT inconsistent with local control. Politicians like RINO-Russ Barry, who migrated to New Hampshire relatively recently, do not understand that local control never meant Athenian democracy for every town.

Rather, local control is the State analog to federalism. A Statewide tax-cap represents a “guard-rail” that provides a level of protection to taxpayers in towns where the “big-spenders” are a majority of voters. In other words, it allows these taxpayers to exercise a degree of local control.

Authors’ opinions are their own and may not represent those of Grok Media, LLC, GraniteGrok.com, its sponsors, readers, authors, or advertisers.

Got Something to Say, We Want to Hear It. Comment or submit Op-Eds to steve@granitegrok.com