After years of making little progress on housing affordability, the Legislature finally is moving forward in large strides. As significant reforms near the finish line, a surge of advocacy has emerged for an old, failed method of addressing the state’s housing shortage: government subsidies.

New Hampshire’s primary method of addressing housing affordability has long been to subsidize construction of rental properties that would lease some or all of their units at below-market rates. And for years, rents have marched ever upward as the overall supply of units has remained well below demand.

It’s easy to see why. In a tightly regulated market where it’s difficult to build new housing at all, adding a few subsidized units will never be enough to bring down market prices. In fact, introducing subsidies into a market with little room for expansion can drive up prices by further stimulating demand.

In 2023, the state created a Housing Champions program to provide financial incentives to municipalities. It allotted $5 million to be distributed as aid to municipalities that loosened their land use regulations to permit more construction. As New Hampshire Bulletin has reported, the governor in her budget gave municipalities more time to spend the fund’s remaining money, but the House claimed it for other purposes and adding no additional money for the next biennium.

Some advocates for increased state subsidies complain that this year’s House approach amounts to using a stick rather than carrots. This mistakes necessary regulatory reform for punishment. It also represents an effort to dilute much-needed regulatory reforms.

By diverting lawmakers’ focus from a proven method of increasing supply and stabilizing prices (deregulation) to an ineffective one (subsidies), some proponents of government control hope to slow progress on housing reform.

Many factors affect housing prices, but as the Josiah Bartlett Center’s landmark 2021 study found, land use regulations have played the lead role in driving up New Hampshire’s home prices.

“New Hampshire is one of the most restrictive states in the country for residential development,” our report found. “By suppressing building, land-use regulations drive up the price of housing as demand rises. Removing or relaxing these regulations would allow prices to rise more gradually.”

Exactly a century ago, during the height of the Progressive Era, legislators granted local governments the power to restrict private property use via zoning ordinances. But this power was not meant to be absolute. The enabling statute, revised in 1983, grants local zoning powers “for the purpose of promoting the health, safety, or the general welfare of the community….”

The intention was to prevent property owners from harming the neighbors. The classic example is building an industrial facility that pollutes surrounding properties or disturbs the peace. Yet over the course of the next century, local zoning regulations experienced significant mission creep. Local boards took to using them not for legitimate health or safety goals, but to plan every aspect of a community’s development, as if they were playing a game of Sim City—with other people’s property.

Towns and cities made it illegal to expand the picture postcard New England villages that had grown up organically over the course of three centuries. Powers intended to prevent neighbors from harming each other wound up redesigning the entire municipal landscape, even in small towns.

This imposed its own set of harms, including sprawl, long commute times and, eventually, a statewide housing shortage. As communities pulled residential restrictions ever tighter, developers and property owners were left with fewer options, all more expensive than the last.

Cash grants, either to developers or municipalities, won’t fix the problem. Both developers and local governments already have huge financial incentives to build. More development means higher profits for builders, and residential developments bring in additional tax revenues for local governments. It’s not true that residential developments as a rule cost towns more than they bring in. Typically they’re a net fiscal benefit for towns. A NH Housing study last year showed how several New Hampshire communities benefit financially from new home construction.

Despite large financial incentives to allow more residential construction, towns are reluctant to loosen their grip. Why? Too many officials fear their town will be the only one to relax its regulations.

Our 2021 housing study found that overly restrictive local land use regulations spread from town to town as local regulators try to push residential development into neighboring communities or simply prevent it from flooding theirs when surrounding towns clamp down.

This arms race is why cash incentives won’t produce statewide improvements. As long as local regulators fear the fallout of tight restrictions next door, defensive anti-housing regulations will persist.

Cash grants are ineffective and unnecessary. The state doesn’t need to spend taxpayer money to convince local governments to stop abusing their powers when it can simply end the abuse by clarifying what powers localities were meant to have.

To be clear, restoring a functioning housing market does not require abolishing zoning. More construction can happen even as municipalities retain substantial zoning powers. Not a single housing bill would end local zoning. Instead, they focus on curbing excessive regulations.

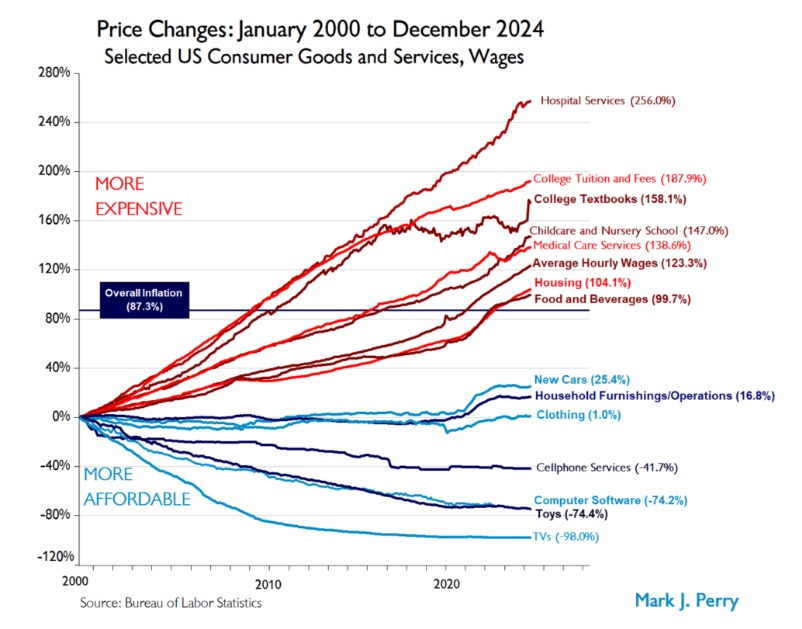

To see why deregulation, not subsidies, is the answer, just look at price changes in U.S. industries that are heavily regulated (such as health care, child care, and higher education) and those that are more lightly regulated.

Economist Mark Perry of the American Enterprise Institute created the handy chart below to show the change in prices for an array of goods and services since 2000, adjusted for inflation. While the prices for numerous consumer goods such as televisions and smartphones have fallen sharply, the prices for services that are heavily regulated (and often subsidized) have skyrocketed.

Federal and state governments heavily regulate certain industries, which experience corresponding price increases. Governments respond by advocating subsidies to offset the price increases caused by their own regulations.

The same dynamic has happened in housing. Subsidies will not pull New Hampshire’s housing market out of this doom loop, but choosing deregulation over subsidies can.

Authors’ opinions are their own and may not represent those of Grok Media, LLC, GraniteGrok.com, its sponsors, readers, authors, or advertisers.

Agree? Disagree? Submit Op-Eds to steve@granitegrok.com – We want to hear from you, too!