If you try to research the answer to this question, you will oddly be misdirected, blatantly lied to, or just given half truths. Artificial intelligence is the biggest offender of the current silver market misinformation, but Google is right up there with lies about what just happened.

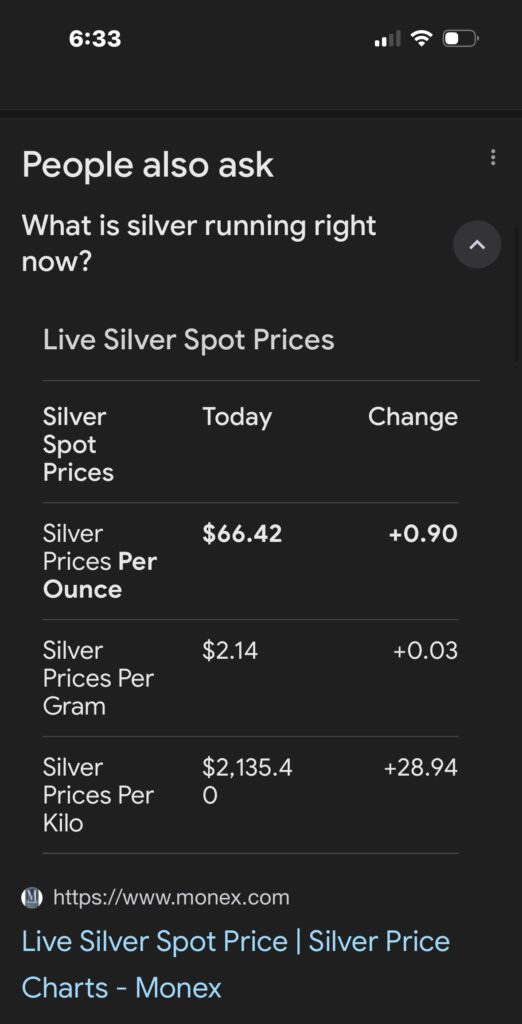

Clearly someone wants you to miss the significance of this event because these silver numbers above aren’t even real.

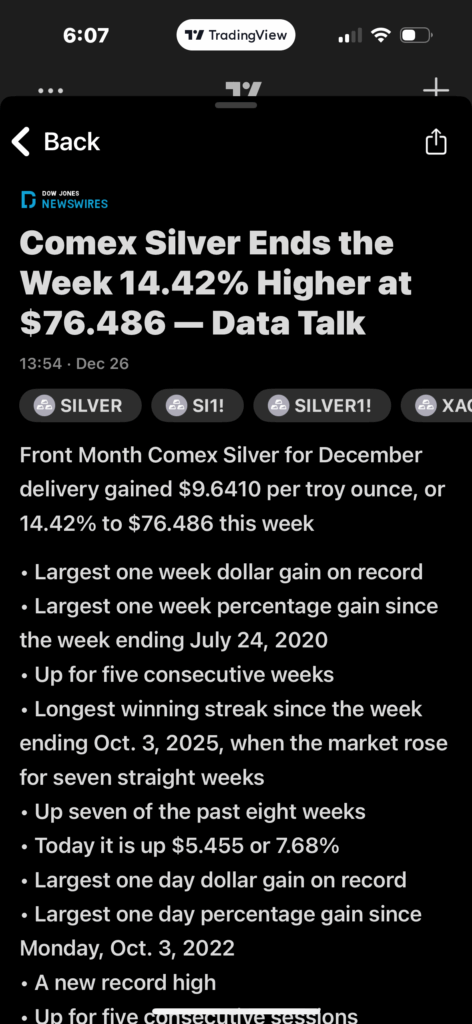

The Silver market took an unprecedented run UP on Friday. The market went up OVER TEN PERCENT IN ONE DAY, to close for the weekend at $79.26. Up $7.45. That’s EPIC! It did NOT chart with gold, as it usually does, which went up just over one percent of its value on Friday. The silver percentage increase of over 10% in one day deserves attention. Its ratio with gold has been off for years, so this separation of charting with gold wasn’t necessarily unexpected, but it shows a very significant shift in a long history of silver market manipulation.

Silver values recently soared past the value of a barrel of oil, wanting to rest at a much higher real price at a ratio closer to gold. A more realistic price for silver is determined by how much silver can actually be mined NOW and be sold today? The unmanipulated ratio of silver to gold is realistically more like 7:1, after being at 60:1 more recently. Remember, gold is still rising while this ratio is now attempting to right itself. Silver isn’t catching up to gold in a static environment. Both metals grow, but silver grows faster until its real production reality sets the price. The real market will eventually reveal itself and that event might be NOW.

The manipulation of the silver market might legitimately be near its end. When buyers want to take possession of their purchased physical silver, at what price will owners actually sell it? What does it really cost to mine and what will sellers let it go for? If they’ll sell it to you at all.

You won’t be allowed to buy silver from China come January 1. China set new rules. https://goldsilver.ai/metal-prices/shanghai-silver-price Some silver mines around the world have recently been monopolized to sell to only one buyer, limiting the available silver even more.

Silver is generally a byproduct of other mined metals, so it’s not as common to find a silver mine on its own. Cheap, easy to mine silver is already gone for the most part. It’ll be years before newly identified silver mines could even try to right this problem. Delivery demands must be met while supply is severely limited. People are buying up what’s available in retail settings such as coin stores and pawn shops, and bigger sellers such as Apmex, JM Bullion, and EBay are using time sensitive algorithms that set a hefty premium over spot. At this moment, it actually costs $88.56 per one ounce silver eagle coin (plus shipping) to take possession of a physical ounce of silver that spot price says is valued at $79.26. Do you see the difference? It’s not really $79.26 for an ounce of silver, it’s actually much higher. The current spot price will not even stay at its current price for long, Shanghai is already trading silver at several dollars higher. The silver market is expected to continue to soar this week, this year, and beyond. Industrial demand and an end to past manipulation factors will set crazy new records. We either need more silver to get mined or we need to increase the price of silver significantly. Clearly the price is attempting to find a new higher priced reality.

The Downfall

As the price increases, the dollar ostensibly collapses. This windfall isn’t as pleasant as it seems. It indicates instability. Imagine having to spend almost $80 for something that was just $20. The paper manipulation of silver is the main reason there is such a huge supply shortage. Futures upon futures have been sold. More silver has been sold than exists many times over. It’s impossible to fix, so the market will naturally try to correct itself. But can it? If one bank fails to deliver, like say…JP Morgan, they will all begin to fall. Failed banks means NO delivery and broken promises all around.

President Trump has been eager to end the Federal Reserve Bank and create a new financial system. Is this what’s happening? Are we watching the beginning of the end?

Authors’ opinions are their own and may not represent those of Grok Media, LLC, GraniteGrok.com, its sponsors, readers, authors, or advertisers.

Got Something to Say, We Want to Hear It. Comment or submit Op-Eds to steve@granitegrok.com