Peer to peer lending is today among the most favorite platforms for investing and borrowing money because it is automated and returns are better than a savings account. Today, the majority of peer to peer lending sites are located in Europe, probably because the concept originated from the continent. Though they are located in Europe, most of the p2p sites accept investors from outside the Continent.

Consumer P2P Lending

The best p2p lending platform in Europe include:

Mintos

Mintos is the leading crowdlender site in Europe. They have a large number of loans as well as loan originators who they collaborate with and has the best diversification, reporting, and functionality. To date, Mintos has financed over 2 billion worth of loans with a return of over 12%. This peer to peer site is also perfect for those who are just starting on crowdlending.

Mintos: Pros

- High rates of up to 15.1% alongside a buyback guarantee

- It is the largest platform

- Easy loan diversification

- Loans come with a buyback option

- The minimum investment is 10 EUR

Fast Invest

Fast Invest is one of the leading consumer p2p lending sites in Europe and allows for loan diversification to reduce the risk and has been business for more than 3 years. What differentiates Fast Invest from other p2p platforms is that it usually proposes loans with high returns above 12%. You can also automate your investment using the platform’s auto-invest feature.

Fast Invest: Pros

- Great returns

- Buyback guarantee on all loans

- Easy to use due to auto-invest option

- Great user interface

Business P2P Lending

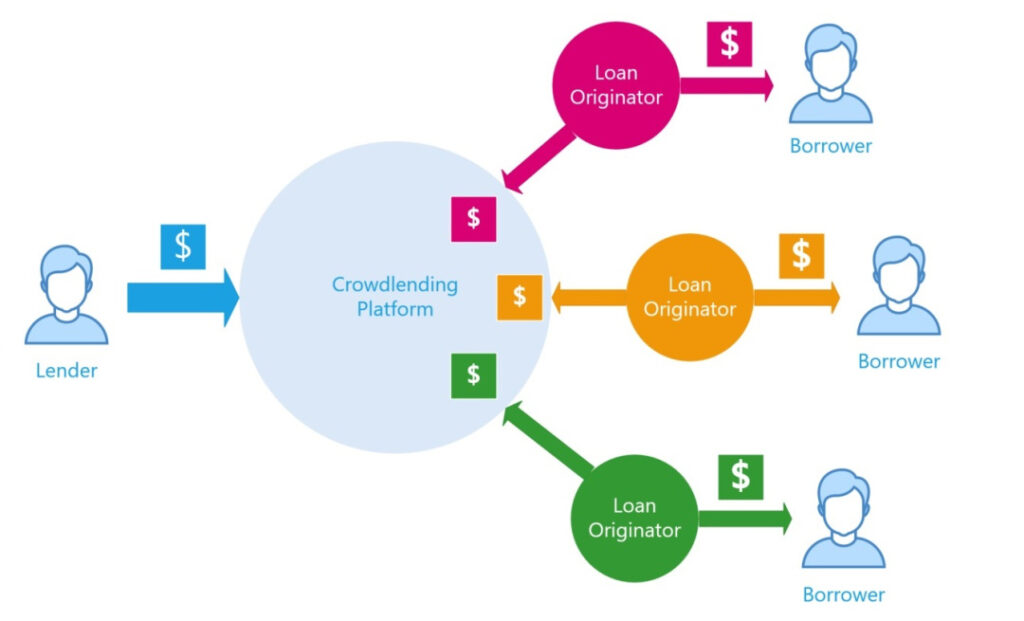

As the name suggests, this type of crowdlending loan’s purposes is for improving the cash flow of businesses. Loans can cover start-up costs (marketing, repair, maintenance) or new-product launch expenses. Crowdlending is an appealing source because businesses can apply for the loans from multiple investors or lenders, thus increasing the chances of approval.

The leading business p2p platforms include:

Grupeer

Grupeer is similar to Mintos but focuses on business loans and development projects. The platform is quite great and has a wide range of loans for borrowers. The loans also come with a buyback guarantee. Most of the loans in the site are at 13% to 14% range and some have periodic cashback campaigns.

Grupeer: Pros

- Higher rates compared to its competitors

- Loan performance

- Periodic cashback campaigns

- Buyback campaigns

- The minimum investment is only 10 EUR

Real Estate P2P Lending

These loans concentrate in three areas: new real estate development loans, buy-to-sell loans, and buy-to-rent loans. The best P2P lending platform in this area in Europe include:

Crowdestate

Crowdestate is one of the best P2P lending sites focusing on real estate loans. Returns are usually high and loan performance is perfect. Like other platforms in this post, Crowdestate also has a buyback option on its loans and cashback campaign for new investors.

Crowdestate: Pros

- Attractive returns of up to 21%

- Cashback campaign for new users

- Great loan performance

- Fairly liquid

- Interesting projects

- The minimum investment is only 50 EUR

*****

From time to time, GraniteGrok accepts content from third parties (posts, or additional links after initial publication) from which we may or may not receive compensation.