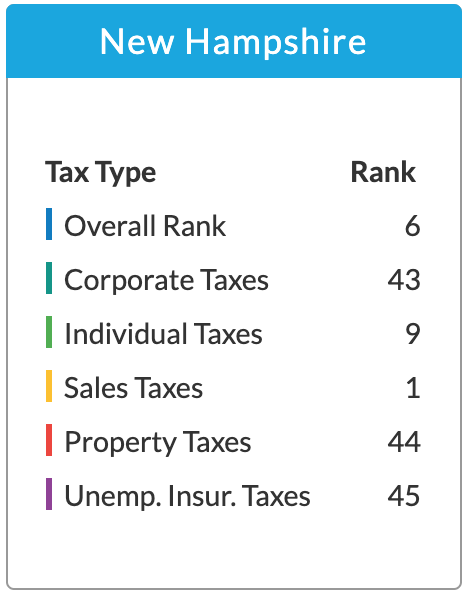

New Hampshire climbed one spot in the annual Tax Foundation report on State Business Tax Climate, from seventh overall to sixth in the nation. Though property taxes, unemployment taxes, and corporate taxes (still) bog us down, our lack of a personal income tax and sales tax keep us in the top ten.

The employer tax relief passed under the previous legislature moved us up the one spot in the overall ranking and three spots in the corporate tax category, proving once again the Governor Chris Sununu was right to make that a red line in budget negotiations.

The Granite State climbed from 7th to 6th overall, and from 46th to 43rd on the corporate tax component, by trimming the rates of both its Business Profits Tax, a corporate income tax, and its Business Enterprise Tax, a value-added tax.

Tax Foundation Business Tax Climate Index

“Thanks to the positive steps New Hampshire has made to provide tax relief to employers, it’s no wonder our state has one of the best environments for businesses to set up shop, expand, and increase economic opportunity for Granite Staters,” Greg Moore, State Director for Americans for Prosperity New Hampshire, said in a release. “This report is further validation that New Hampshire is the gold standard in New England for attracting businesses and workers and demonstrates why our economy is booming. While we should be excited about our growth, we must continue working to make our state even more competitive and move our state to number one.”

Room For Improvement

6th in the nation is a nice place to sit in the report, especially compared to our neighbors Mass, Maine, and Vermont at 36th, 33rd, and 44th respectively. Connecticut and New York are two of the lowest ranked, at 47th and 49th, with Rhode Island rounding out New England at 39th.

There is little doubt that New Hampshire is the most attractive place to open up shop in the Northeast, but there is still room for improvement to get closer to or achieve number one status.

Corporate Taxes

While we don’t tax individual income or levy sales taxes, there are still barriers holding us down. We’re still 43rd in the country for corporate tax rates, and the next round of employer tax relief won’t go into effect unless the Granite State exceeds revenue expectations by 6%.

Over the past three years NH’s business tax revenues have far exceeded the generally conservative revenue estimates, creating large surpluses. Lawmakers this year debated increasing the tax rates on business back to 2018 levels in a booming economy in a budget that was ultimately vetoed and sustained. The compromise second budget did not include tax increase on employers unless the revenue mark is missed on the low end by 6%.

If the revenue mark is missed on the low side, it will be a signal of a slowing economy not a failure in tax policy. Regardless of the surrounding economic circumstances leading to the decline in tax revenue, the Government will surely ‘get their share’ from businesses and employers, worsening the problem.

Our employer tax rates should be reduced as scheduled regardless of outside economic forces. A more favorable business environment would lead to increased investments in our economy and make us even more of a desirable location during the next economic downturn.

Property Taxes

Everyone knows property tax costs in New Hampshire are exorbitant. Unlike business taxes, these numbers are not dependent on profit or revenue, but are a direct correlation to the real property you or your business owns, and how your town or municipality assesses the value.

Widely varying bills

NHBR.com “Assessing the Business Tax Burden”

New Hampshire businesses owed nearly $6.5 billion in property taxes from 2007 to 2017 and paid $5.8 billion toward the BPT and BET, according to data provided by the state Department of Revenue Administration and calculated by NH Business Review. Only two years, 2007 and perhaps 2018 (final corporate tax figures aren’t in yet), businesses paid more in corporate taxes than property taxes.

The property tax revenue is set statewide before the tax rate is set. Meaning, the amount of money raised is a pre-set determination that correlates to the budgets set in municipalities and counties statewide. Reducing our property tax burden will require innovative thinking in our towns and cities along with a number of tough choices.

Rates vary wildly across the state. Claremont had the highest rate in 2018 at $42.08 per thousand, but New Castle’s rate was only $6.

Bedford, an economically booming town, sits at a rate of $20.40 as of 2018, below the statewide average of a little over $21.

Towns, and the voters inside them, need to start thinking critically about what gets funded and how if we have any hope of lowering tax rates in this state. A more involved electorate is definitely one of the missing links, with the average town meeting turnout far below 20% of eligible voters.

Individual Taxes

How do we rank #9 in individual taxes, you might be wondering, without having an income tax?

Well, we do have an income tax. It is levied on investments and dividends if you earn more than $2,400 per year ($4,800 jointly) on I&D. The 5% income tax has faced scrutiny and proposals to repeal it in recent years, with all of those measures failing.

I&D Taxes are generally paid by higher income earners, but also affect retirees in the Granite State on fixed incomes. This tax brought in $114 million in revenue in FY’19, up almost 8% from the year before.

If New Hampshire is to truly be an income tax free state, the I&D Tax must go.

Energy Costs

Not a direct tax, but a cost to employers and residents none the less is the cost of energy in the Granite State. We rank 45th in the union at an average cost of 19.4c/KwH according to chooseenergy.com.

If New Hampshire is to truly become an economic driver in the country and the region electric rates must be lowered, substantially. A lot of these costs can’t be mitigated without new energy sources, but the regulatory structure of our energy market.

Renewable Portfolio Standards could be wiped out in the same way RGGI (Regional Greenhouse Gas Initiative) was, whereas nearly 100% of the monies paid into that system are rebated to the ratepayers. RGGI is largely a deadweight program, and we can do the same with RPS.

On January 1, the Granite State repealed the electricity consumption tax, a small tax that took $6 million largely out of the pockets of businesses and industries operating here. We need to do the same with systems benefit charge, which was increased by the PUC (Public Utilities Commission) in 2016. The rate increase was due to the EERS (Energy Efficiency Resource Standard,) which allows your power company to come give you those “free” energy audits and offer other “services” that are paid for by all ratepayers.

We absolutely must oppose expanding any electric subsidies, such as Biomass handouts or increased net metering. If you’re unfamiliar, net metering is a system in which electric distributors must buy renewable energy that is back-fed into the system at retail rates. Most net metering occurs when the consumption rates are lowest, unsurprisingly, when the energy isn’t needed. Any net metering program must not rely on forced retail rate payments that drive up costs for other electric consumers in the state.

The Granite State Can Be Number One

Given a few years and intelligent legislative decisions, our small slice of heaven can be number one for Business Tax Climate, and can reattain number one in economic freedom. It will take some hard work, some innovative thinking, and a lot of political courage. Putting these issues first will create a diverse and driven economy that will lead to greater growth and greater quality of life for all of those who desire to Live Free or Die.