Is a 19.35% increase in FICA big enough to do the job?

A House Ways and Means subcommittee has held four separate hearings on the insolvency of Social Security. Subcommittee Chairman John Larson recently released a bill, the Social Security 2100 Act, to shore up Social Security’s funding. The bill, which 203 of his Democratic colleagues co-sponsor, includes tax increases. Specifically it increases the amount of social security withholding by 19.35%. (2.4% increase divided by 12.4% current rate)

Is zero co-sponsors really bipartisan?

It is interesting listening to the bipartisan noise issuing forth from New Hampshire’s legislative delegation about bipartisanship. Congresspersons Pappas and Kuster, as co-sponsors, are trying to do now with Social Security what they did with healthcare and that has worked out so very well. There are zero co-sponsors of this legislation from the opposition party. How is it reasonable to modify such an important program with zero support across the aisle? Show me the bipartisanship!

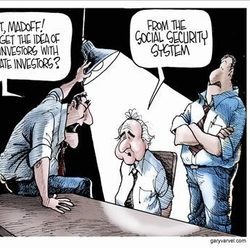

Current program problems

The bill should be of interest to a group that does not usually get much attention in conversations about Social Security; young people. Millennials are a group for which the broader consequences will be felt for a long time. The future of the workforce, younger people, should be explored not exploited. Before implementing plans to hike taxes on workers, and employers is viewed as the answer to the program’s insolvency all avenues need to be explored.

The IRS considers a taxpayer insolvent when his or her total liabilities exceed his or her total assets. We know Social Security is already paying out more than it is taking in. If it is not insolvent today it soon will be. We know Boomers are retiring. That means they are changing from paying into the system to taking benefits from the system. We know the workforce is not replacing those tax payers as fast as they are leaving the workforce. The Social Security 2100 Act hikes the payroll tax by 2.4%, to 14.8%.

Today, almost half of workers do not pay income tax. They do pay Federal Insurance Contributions Act (FICA) Social Security and Medicare payroll tax. It is the largest tax most workers pay. Increasing it takes dollars from the poorest workers and gives it to retirees. This is money that would be used by millennials and other young workers for food, transportation and rent. This confiscation strikes workers at the beginning of their career particularly hard. It deprives them of a longer savings window.

Millennials really should care. Here’s why.

Millennial workers are different from other generations in significant ways. They are more likely to start their own business. Over a third of millennials operate a “side hustle” in addition to their full-time job. This means many young people in the workforce today are not only employees, but potentially, employers as well. As a sole proprietor, they are responsible for both the employer and employee sides of the payroll tax hike in the plan. This potentially increases their payroll tax exposure significantly.

This tax hike on this regressive payroll tax makes each hire for an employer more expensive. The data shows employers rationally respond to such tax hikes by cutting wages or reducing numbers of employees. This will diminish income mobility and opportunity for workers. Those at the beginning of their careers are particularly hard hit.

It puts wage increases further out of reach for workers. The income exemptions in this bill are not indexed to inflation. They eat up more dollars of employee income over time. The result is erosion of young people’s earnings opportunities as they move up the income ladder. The bill takes dollars directly out of every workers household budget. This is a reduction in standard of living.

Millennials lag other generations in wealth accumulation. Workers at the beginning of their careers see a higher share of their income go to payroll taxes. Fixed costs of living take up a higher share of their take home pay than has historically been the case. Increasing the payroll tax further diminishes the amount of money they have available to save and create wealth over time.

This exacerbates the disparity between the largest living generation in the country and the generations that have come before it. Data indicates that lower-income households make up for the loss of income by shouldering more debt. That debt undermines opportunity for young workers to amass their own wealth. This is something they need to do for their own retirement.

Today’s workforce looks different than the workforce of prior generations. As our economy evolves our public policy too must change. For many millennials the recent economic expansion has been their first opportunity to grow in their careers and build wealth. Proposals that force this cohort to shoulder new and greater tax burden threatens to undermine their financial health.

Conclusion

Congress has enhanced private savings opportunities to the benefit of workers. But, it has yet to tackle the looming fiscal insecurity of government spending. Congress should consider methods of meeting this challenge without simply shifting the financial burden to future generations. Why are we taking from the children to give to their grandparents… who created the problem and refused to deal with it? Don’t pass that monkey! If they try don’t take it!

Ref:

Washington Examiner, By: Mattie Duppler, April 12, 2019

FreedomWorks, Morning Update, April 16, 2019